Five Tips for Growing in a Recession

While the National Bureau of Economic Research is still debating whether we’re in recession, it’s clear many US households are in for a rough ride. Consumer confidence is down for the third consecutive month[i], we’ve had two quarters of negative GDP growth[ii], and 75% Americans are “very concerned” about rising prices for food and consumer goods.[iii]

Seasoned business leaders may be tempted to dust off recession playbooks from 2008, but things look a lot different this time around. In addition to lingering post-COVID supply chain challenges and conflict in Ukraine, Americans are facing significantly greater economic headwinds:

-

- Gas prices (while abating) are averaging $4.20 per gallon

- Inflation for food at home is north of 12%, 2.5x what it was in 2008[iv]

- SNAP participation rose from 28MM individuals in 2008 to 42MM in 2021[v]

- The average home price to median income ratio increased from 6.0 to 8.3 since 2008[vi]

Thankfully, with the right strategy, brands can not only survive, but thrive in this environment – and better deliver on consumers’ evolving needs – provided they act decisively and lead vs. follow. Read on for Seurat’s tips for growing in a recession.

1. Welcome consumers “feeling the pinch” into your brand.

During periods of expansion, businesses can afford to remain focused on a singular consumer target. The result is consumers most likely to feel an economic pinch tend to be overlooked, despite tremendous collective buying power. (The total spending power of US households earning less than $70k per year is a staggering $2.3T.[vii])

Savvy brands see value in identifying and recruiting secondary consumer targets, which often means casting a wider socioeconomic net. Consider the meteoric rise of buy now pay later services, which funnel an estimated $120B in global spending[viii]. Nearly 25,000 merchants, including household name brands like Kiehl’s and Vital Proteins, now let shoppers pay in installments interest-free through Afterpay[ix]. The service has allowed these brands to access a new cohort – younger shoppers who don’t buy on credit.

Our Equity Expansion practice is designed to help brands reach new consumer cohorts – including those most likely to feel an economic pinch – by building empathy and optimizing go to market.

Our Equity Expansion practice is designed to help brands reach new consumer cohorts – including those most likely to feel an economic pinch – by building empathy and optimizing go to market.

2. Pivot communications to highlight value.

Research has shown that even in a recession, brands still need to invest in equity-building. And with material costs at a record high, brands can’t afford to keep buying down price through promotional spending. The answer? Stop focusing on price, and pivot comms to showcase the numerator of your value equation.

Take LL Bean’s recent campaign celebrating durability. Inspired by the true story of an eight-year-old girl who wanted a new backpack and wrote a letter to the company asking how to wear it out, the campaign smartly focuses on defining value through long-lasting quality, not price. Highlighting value often means reframing the equation, the way powdered beverage mixes celebrate more servings relative to a jug of juice or two-liter of soda.

Our marketing strategy pillar helps brands celebrate their value equation, identifying the right message to resonate with the right consumers at the right moments.

Our marketing strategy pillar helps brands celebrate their value equation, identifying the right message to resonate with the right consumers at the right moments.

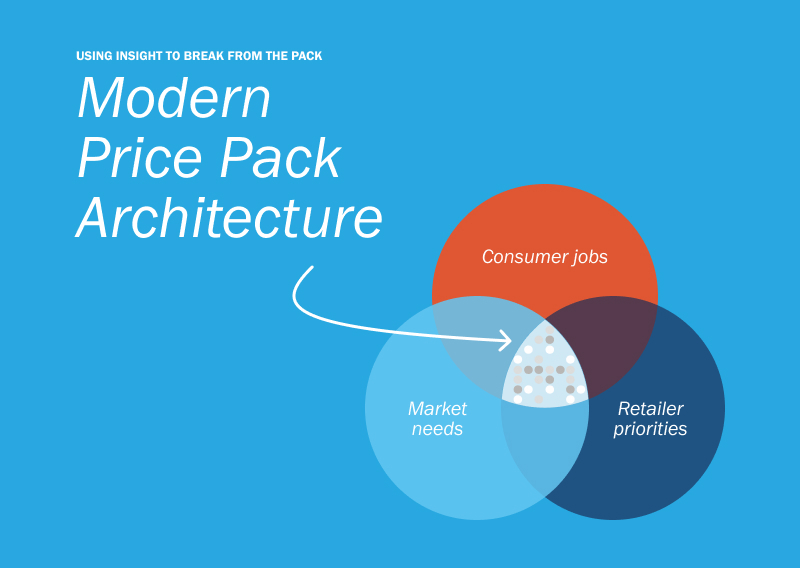

3. Reimagine price/pack architecture.

When costs rise, manufacturers are quick to leverage price / pack architecture to protect and even juice margins. But consumers have gotten wise to “shrinkflation” – many responding with public outrage – and a recession isn’t the time to start chipping away at shopper value. When the going gets tough, smart brands turn to Strategic Revenue Management, tweaking product sizes and pack configurations to optimize for value-conscious shoppers.

Consider Dove body wash on Amazon. As of this writing, a single 16.9 oz bottle sells for $0.48/oz. For shoppers who have the budget and space to buy and store more inventory, a three-pack of 28 oz bottles sells for 40% less at $0.29/oz. Similarly, confectionery manufacturers are shifting to smaller, even single-serving packs at lower price points that allow consumers to indulge without breaking the bank.

Our SRM practice – perhaps the least sexy but one of the most important drivers of value creation – helps brands design and optimize portfolios to balance shopper value with profitability.

Our SRM practice – perhaps the least sexy but one of the most important drivers of value creation – helps brands design and optimize portfolios to balance shopper value with profitability.

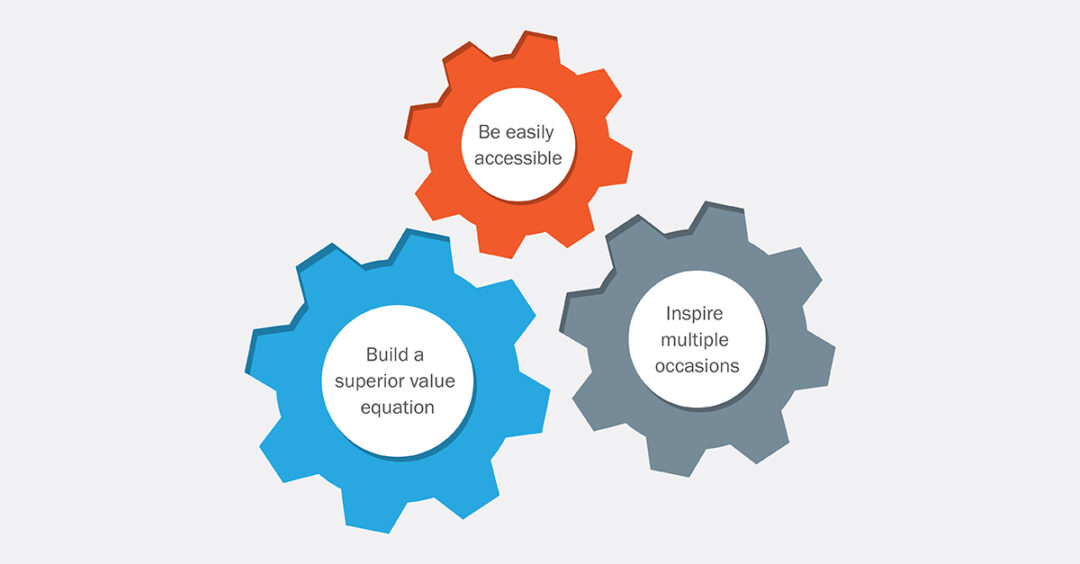

4. Make yourself indispensable.

Products seen as catering to wants vs. needs are typically the first to go in a recession. Smart brands make themselves indispensable by continually reminding consumers of the need they’re solving or pain point they’re alleviating. The trick is leveraging smart marketing to connect to basic needs, like safety, security and wellness.

When condom sales plummeted during COVID as the virus wreaked havoc on non-monogamous hookups, Trojan retrenched in messaging about protection and STI/STD prevention. The brand remains the best-selling condom today – all the more impressive given its premium price position.

Our brand architecture practice helps brands sharpen their reason for being – including positioning themselves as indispensable in the lives of consumers – ultimately boosting ROI through more effective marketing.

Our brand architecture practice helps brands sharpen their reason for being – including positioning themselves as indispensable in the lives of consumers – ultimately boosting ROI through more effective marketing.

5. Nurture relationships with the right customers.

With economic headwinds, shoppers make different choices about where and how they buy – forcing businesses to revisit channel prioritization. For many, this will require renewed focus on Walmart and “alternative” channels like convenience, dollar and discounter (e.g., Aldi). For others, it will mean doubling down on existing customer relationships as customers re-evaluate priorities and partnerships.

Successful brands engage in joint business planning, prioritizing category growth over individual brand priorities. That means bringing breaking the cycle of SKU-level line reviews and bringing forward-looking insights and thought leadership.

Our customer leadership practice helps brands elevate their relationships with omnichannel retailers, positioning them as strategic partners vs. transactional vendors.

Our customer leadership practice helps brands elevate their relationships with omnichannel retailers, positioning them as strategic partners vs. transactional vendors.

Looking to ensure your business is wired to grow in the next 12-18 months? Contact us at info@seuratgroup.com.

[i] https://www.conference-board.org/topics/consumer-confidence

[ii] https://www.bea.gov/news/2022/gross-domestic-product-second-quarter-2022-advance-estimate

[iii] https://www.pewresearch.org/politics/2022/07/13/bidens-job-rating-slumps-as-publics-view-of-economy-turns-more-negative/

[iv] https://www.bloomberg.com/news/articles/2022-07-12/grocery-inflation-hits-new-york-city-san-francisco-atlanta-with-big-increases; https://www.usinflationcalculator.com/inflation/current-inflation-rates/

[v] https://www.fns.usda.gov/pd/supplemental-nutrition-assistance-program-snap

[vi] https://www.longtermtrends.net/home-price-median-annual-income-ratio/

[vii] https://www.census.gov/data/tables/time-series/demo/income-poverty/cps-hinc/hinc-06.html

[viii] https://www.reuters.com/technology/buy-now-pay-later-business-model-faces-test-rates-rise-2022-06-10/

[ix] https://www.digitaltransactions.net/north-america-becomes-afterpays-largest-market-for-its-buy-now-pay-later-services/