Moving from Respond to Reimagine: Leading Customer Engagement in the Next Normal

Radical Change in Retail

The pace of change among incumbent retailers in the consumer goods industry has historically been painfully slow. Despite many aisle reinvention projects, ‘stores of the future,’ in-store theatre, and shopper marketing programs, executional change has been measured in small increments: one additional facing, one incremental display, one shelf added to a category, or one more household adopting click and collect.

COVID-19 has clearly changed this dynamic. Retailers had to quickly respond to shopper behavior disruption and manufacturer supply realities with significant changes in-store, online and in fulfillment. Whole departments, such as Deli, were upended to address health and safety concerns with prepared foods, while store layouts were shifted to manage shopper flow and distancing requirements. Space and inventory holding power were quickly re-wired to meet radical shifts in demand overall and for specific products (e.g., paper and cleaning products), as well as ramp up for different fulfilment models such as click and collect.

Many manufacturers and retailers benefitted from these rapid changes, particularly shifts in consumption back to the home, consolidation of shopping trips, and re-prioritization of consumer needs that spiked demand for safe, convenient, and high-value brands and products.

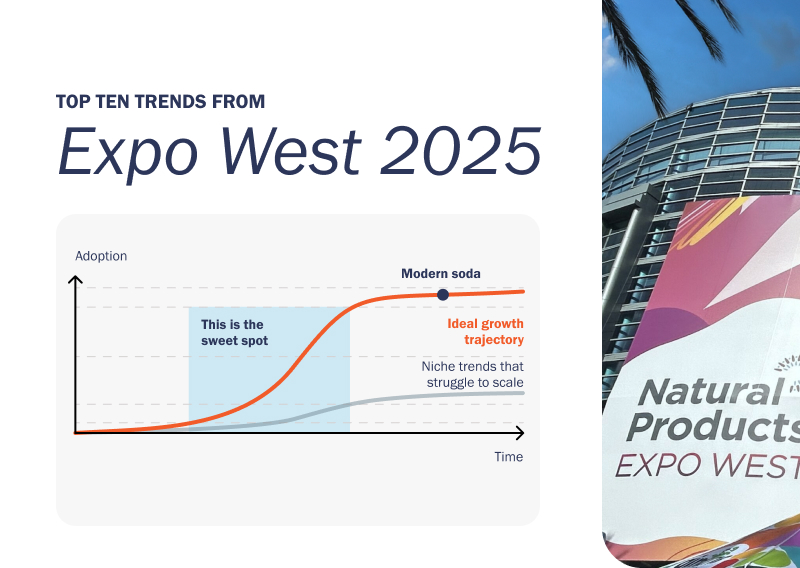

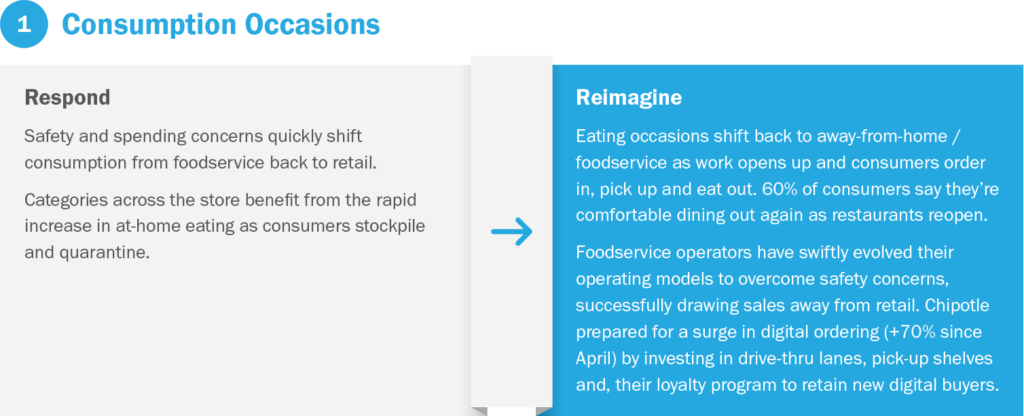

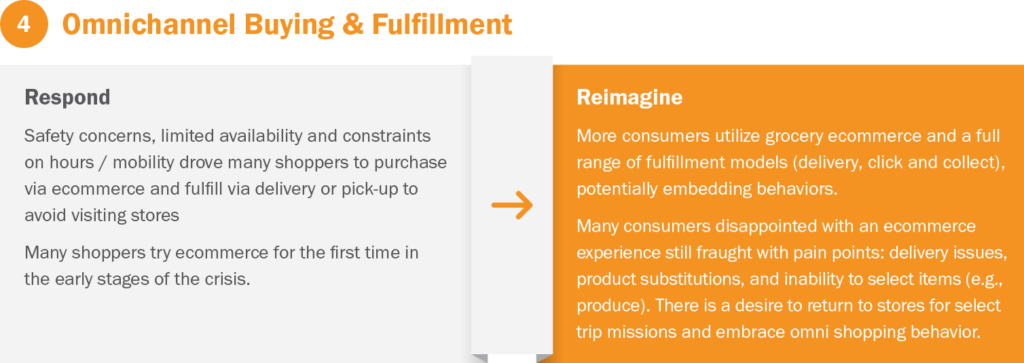

We are quickly moving past the respond phase and do not believe the recent past provides a complete picture of the future.

The COVID-19 accelerant is now ushering in an unprecedented reimagine phase across the retail landscape, bringing changes within the next six to twelve months that historically would take five to ten years to develop. This presents both massive opportunity and risk for manufacturers. Shifts in consumption and shopping behaviors will drive continued change at retail and elevate the importance of influencing shopping behavior across an evolving, complex purchase journey.

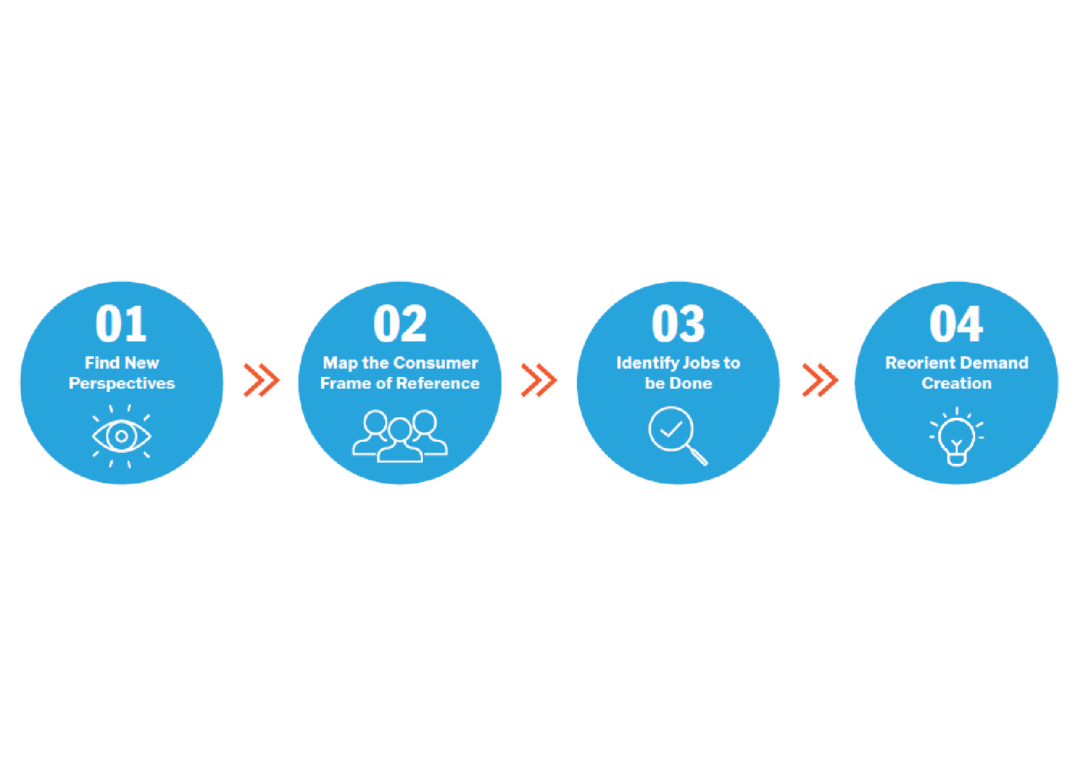

More than ever, manufacturers need to be proactive to create customer planning engagement or risk having outcomes determined for them. Winners will influence customer planning conversations by using new insights to reimagine the category vision, growth drivers and brand roles. Our ongoing dialogue with consumers, shoppers, and retailers reveals four key areas of focus to reimagine the growth vision for each category:

Implication: In the face of renewed foodservice consumption, trading partners must identify ways to bolster the retail/at-home offer. Each category and brand must continually evolve their offer and value equation to maintain share-of-stomach gains from the respond stage.

For example, Deli is critical to meet demand for fresh, convenient, and great-tasting foods, but must shift from open, self-serve bars to a safer packaged assortment to compete with away-from-home options.

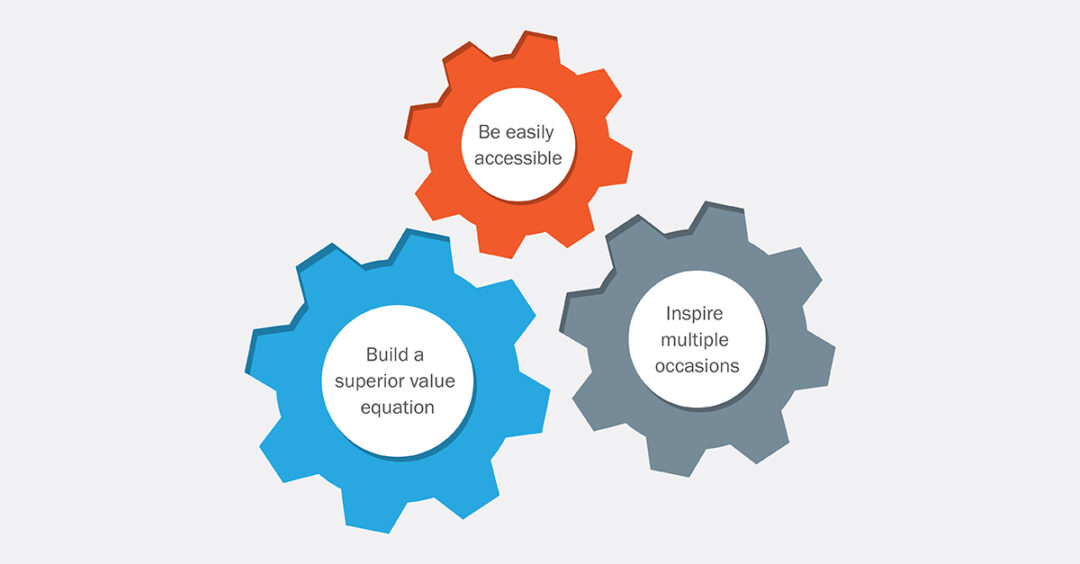

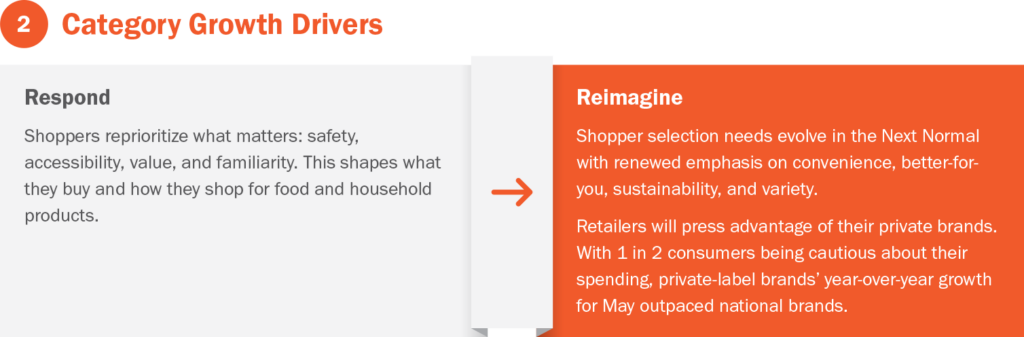

Implication: Re-orient category growth drivers and brand roles to address evolving consumer and shopper needs. Manufacturers need deep insight into why consumers are changing behaviors to identify what will ‘stick’ during the reimagine phase and how to deliver value to different tiers within a category.

Brands that played premium roles will need to demonstrate how they address a broader demand landscape and meet the needs of consumers making changes due to financial impacts of COVID shutdowns.

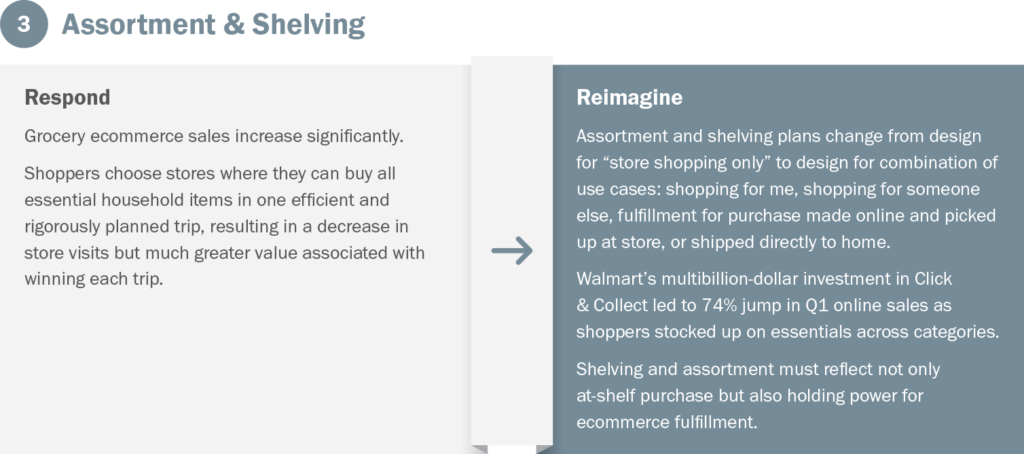

Implication: As shoppers make more planned trips, brands must be top-of-mind, prioritizing physical availability and visibility both in-store and online. Manufacturers need to build omni-channel shelving guidelines and partner with retailers to influence category strategy at shelf (share of space, brand blocks, shelf position) and online to both influence and deliver on demand. This requires factoring in holding power and optimal mix to meet the needs of a range of fulfillment options and incorporating strategies to influence shoppers at the point of purchase.

For example, as online sales in the Vitamins, Minerals, and Supplements category grew 15% vs. last year, manufacturers like Olly are helping retailers like Target use their .com business to compete for sales against a proliferation of direct-to-consumer players. In parallel, manufacturers are leveraging their growth online to ensure right availability, holding power, and brand blocks in-store to support other fulfillment models.

Implication: Provide a seamless omnichannel shopping experience for those who are interacting with retailers and brands across more touchpoints. Retailers need to provide operating models that delight and deliver on shopper demands before expanding service offerings. Manufacturers need to apply new insight through the various paths to purchase and identify implications for driving demand at the point of purchase to plan with retailers.

Follow the lead of manufacturers who are already providing visibility to total omni behavior to develop optimal online programs and physical retail recommendations that reflect online needs and in-store fulfillment.

Reimagining the Next Normal of Customer Planning

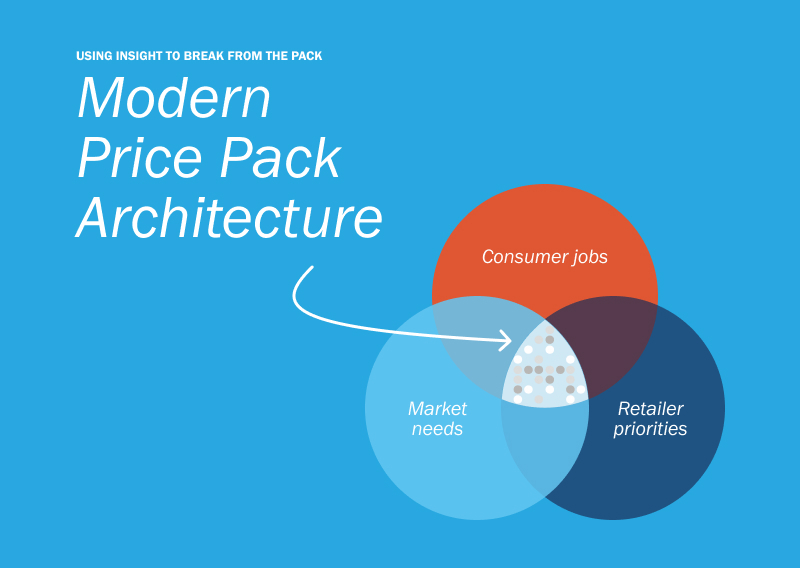

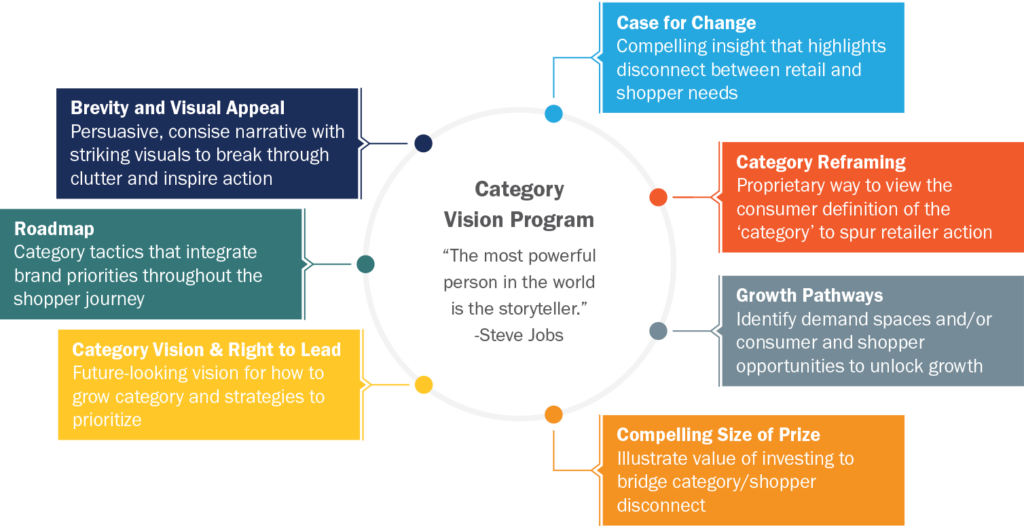

Winning manufacturers have a vision for creating category value grounded in a new insight foundation, using a forward-looking lens to understand where shopper behavior and decision criteria are headed.

Value comes from translating this insight into a category vision program that reimagines solutions for the four aspects outlined above and is communicated through a persuasive selling narrative that can be adapted to key customers and channels.

Seurat recommends the framework below to create the vision, narrative, and program to increase customer engagement during this pivotal window of shopper and retailer change.

Reach out to the Seurat Group at info@seuratgroup.com for additional thoughts on building an insight foundation and category vision to capture long-term growth through the reimagine phase and beyond.