What is Your Category Leadership Plan?

What has changed?

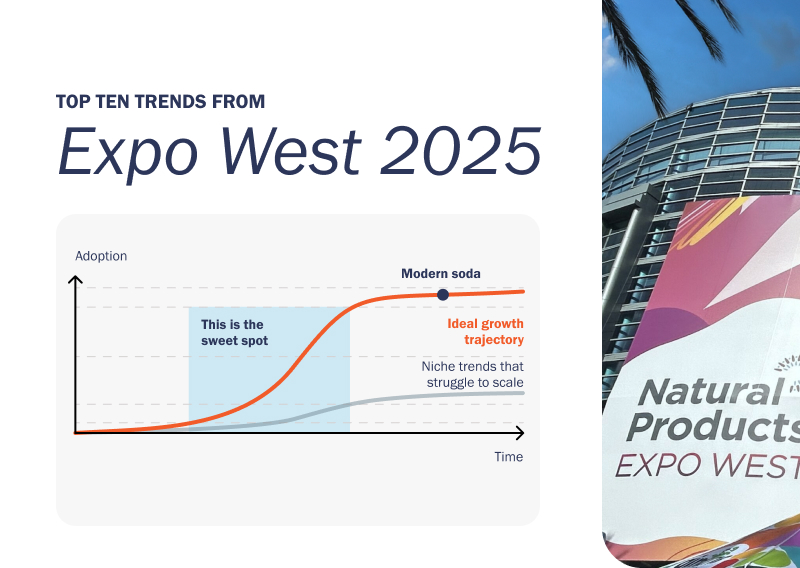

Retailers are seeking forward-looking, omni-channel insight and leadership from manufacturers to ensure they are anticipating trends and continually building category value. This means that the concept of category leadership has become democratized. No longer do you need to be ‘assigned’ category captaincy to be a valued go-to partner and ally. Being a valued partner does not rely on the size and scale of a manufacturer’s business alone.

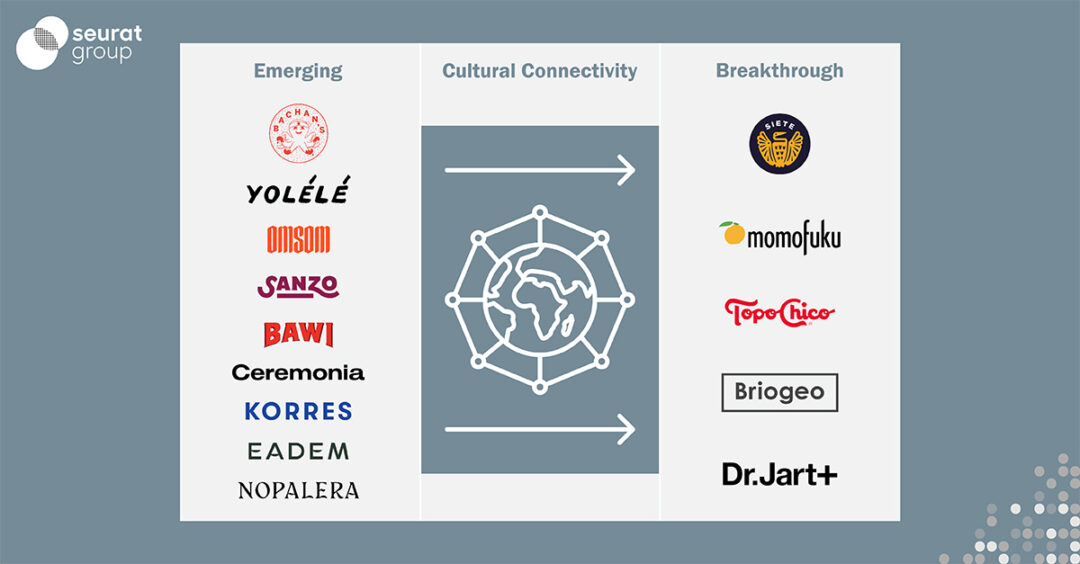

Instead, brands of all sizes can influence omnichannel execution by leveraging a unique point of difference to drive value with consumers and unlock a win-win-win proposition (brand + retailer + shoppers). Even brands with 5% share can disrupt and earn the right to execute by leaning into their strengths and clearly articulating their joint value creation vision.

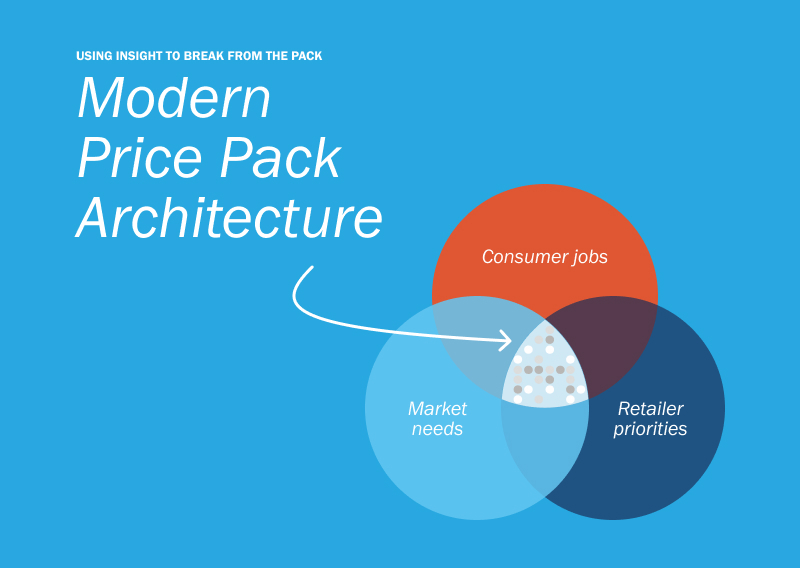

In this new democratized landscape, a new approach is required to ensure that category leadership is an integrated discipline within your total demand planning. Success depends on the manufacturer’s ability to bridge the disconnects between the current landscape and where the shopper is heading with a clearly articulated vision.

What is the new approach?

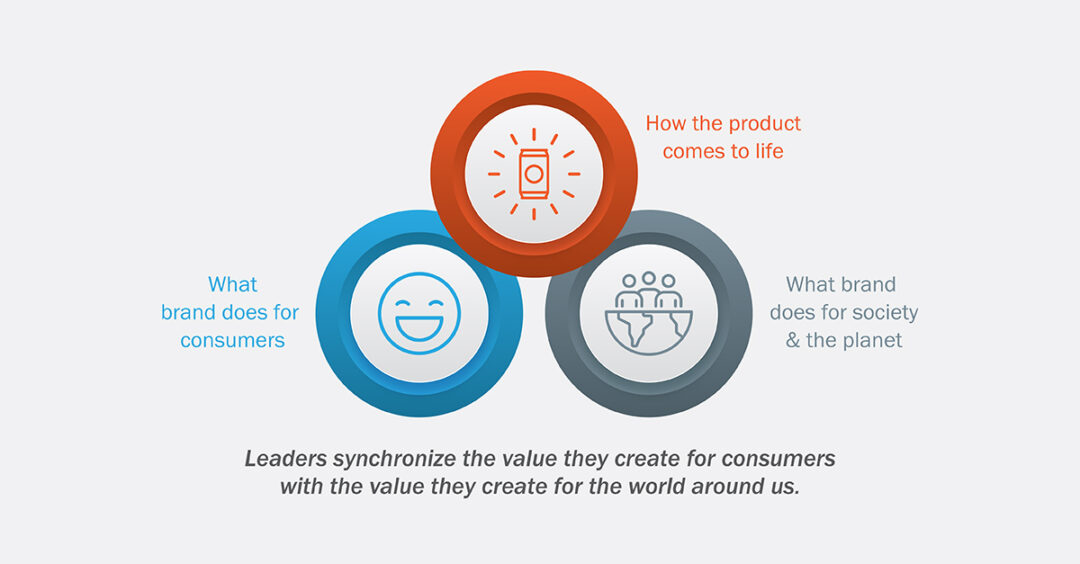

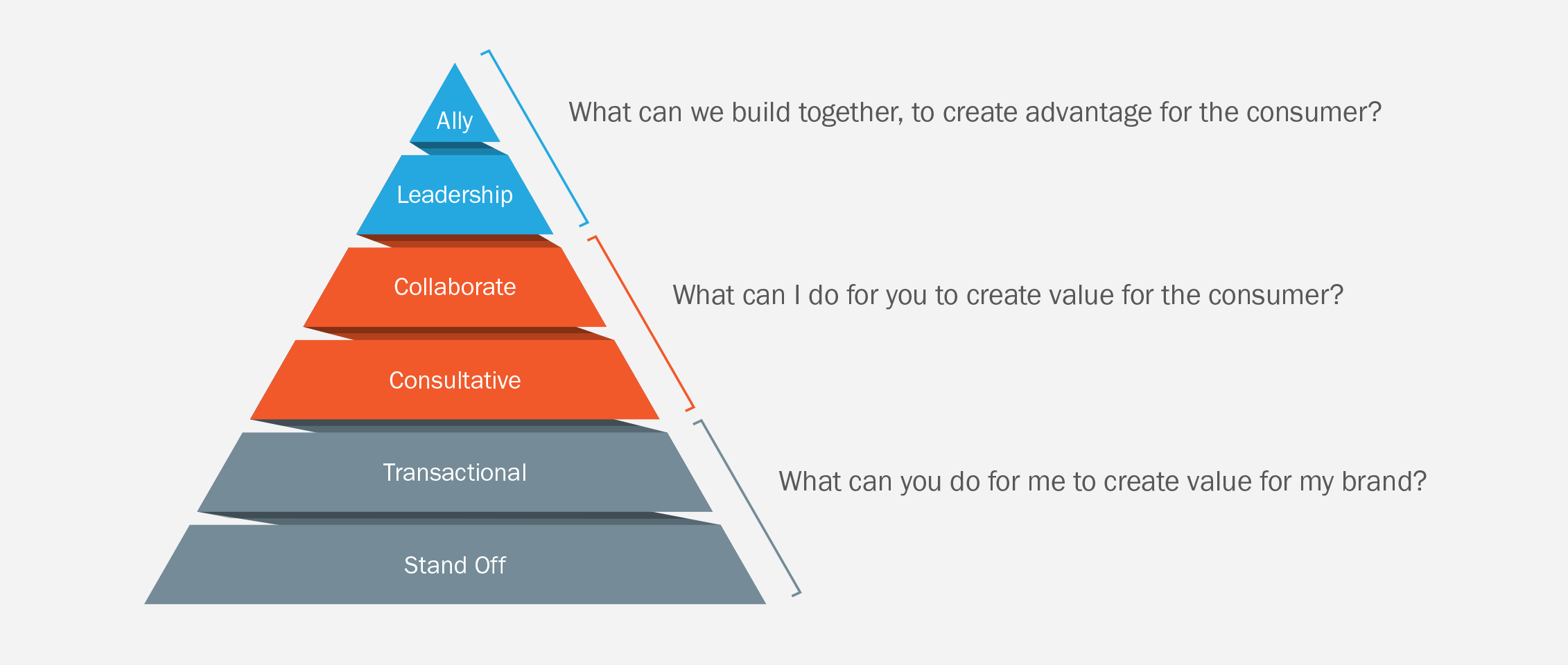

Brands that execute category leadership successfully are not just transactional sellers attempting to negotiate terms that benefit themselves. Rather, they are allies who bring perspective on how brands and retailers can both invest and act to mutually move toward a better future state.

From Transactional to Ally

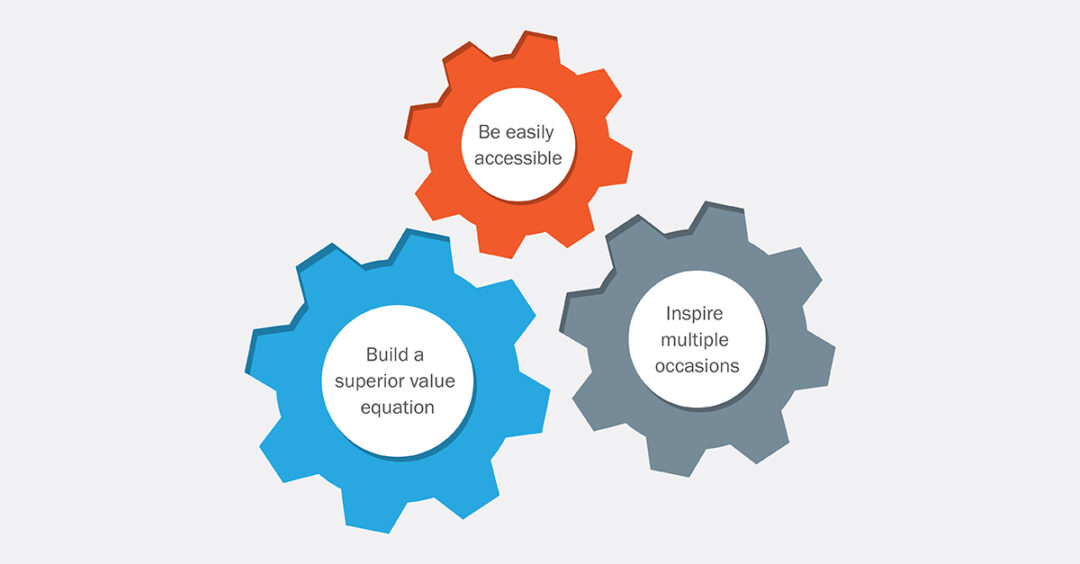

Where to Begin: 5 Value Levers

We have outlined 5 potential value levers that winning brands employ to build effective category leadership narratives with meaningful outcomes.

Conclusion

We welcome a discussion about what your brand’s category leadership could look like!

To discuss any of these ideas further, please contact us at info@seuratgroup.com.