Challenger Brand Study 2026

Challenger Brand Study 2026

Challengers who modernize and redefine thier categories

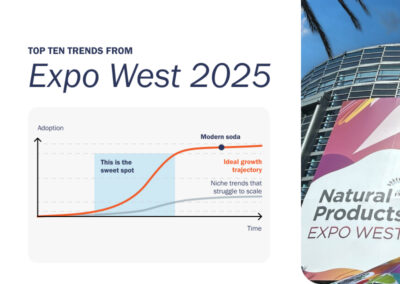

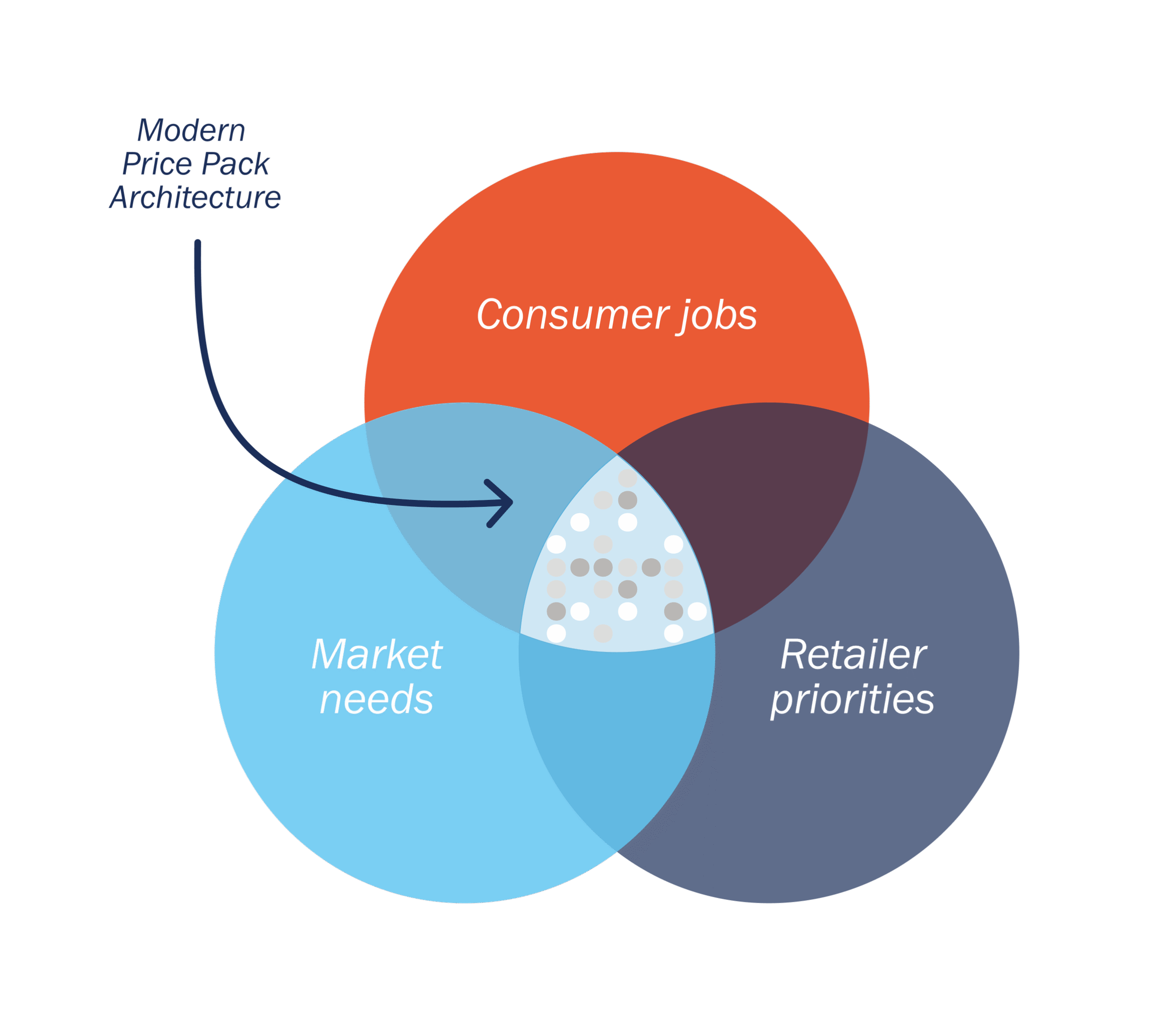

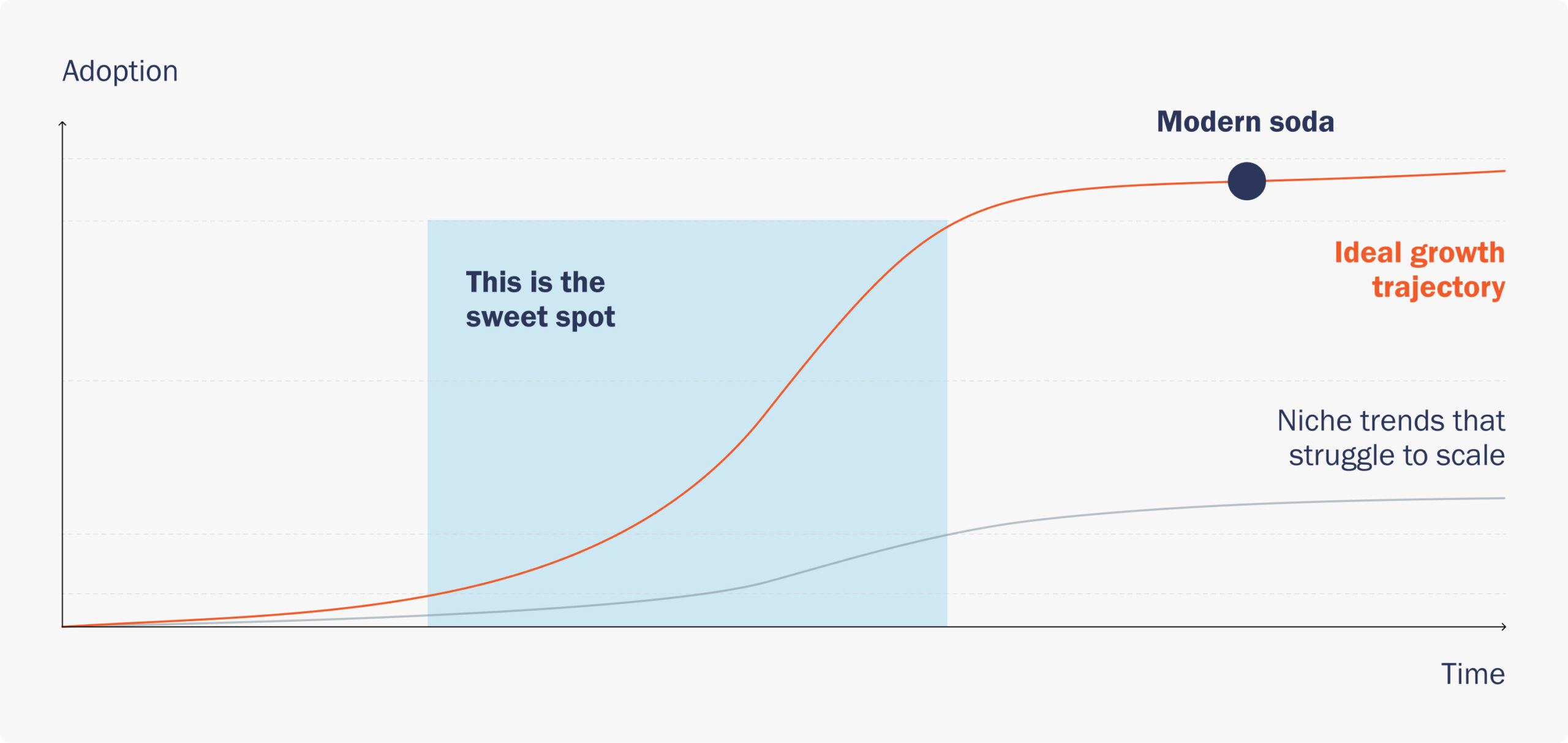

Challenger brands are lauded for their disruptive values and their outsized contribution to CPG growth. While many “challenger” brands often play on the fringes, true breakthrough comes from going beyond niche disruption to redefining and modernizing existing categories.

This year’s study focuses on the next wave of challenger brands that are reigniting both consumer relevance and growth within their categories, not just for themselves.

Against a backdrop of stagnating unit growth and rising anti-consumerist sentiment, these brands demonstrate how to drive durable category value creation. They’re infusing new energy and modernity into sleepier categories by leaning into better-for-you ingredients, unlocking new consumption occasions, and leveraging lifestyle-driven branding to deepen consumer connection. In doing so, they’re pulling their categories back into the cultural zeitgeist and bringing new consumers into the fold.

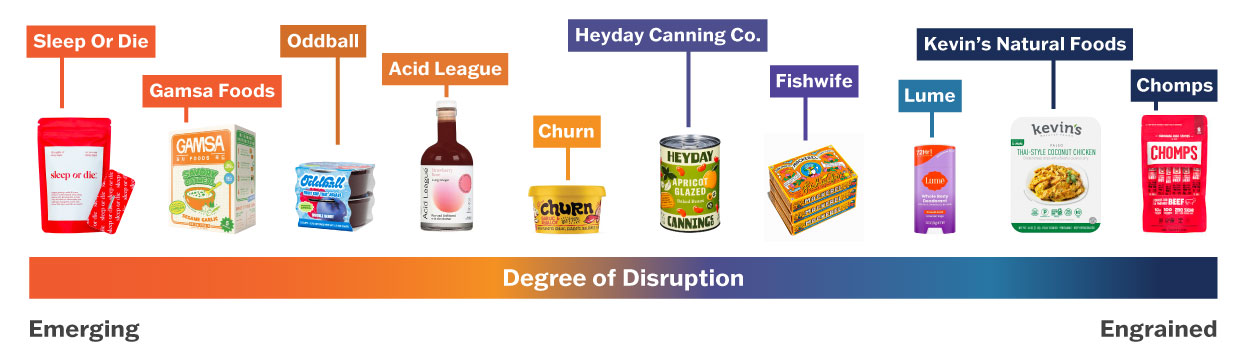

We are excited to highlight 10 challenger brands across a spectrum of disruption: from emerging challengers pushing boundaries to more established modernizers that have already reshaped consumer expectations.

What stands out across these brands is not a single playbook, but a shared orientation in designing for the future of the category, not fenced in by its present.

Challenger Brand Category Impact Spectrum

Sleep or Die: Sleep or Die is jolting the sleep aid category awake with provocative energy and functional credibility in a space that long felt clinical, lifeless, and, well, sleepy. Recognizing that millennials and Gen Z are desperately seeking rest but rejecting the sedative-heavy, side-effect-laden solutions of the past, the brand taps into a cultural shift where younger consumers are embracing wellness rituals but still crave the bold aesthetics of nightlife culture. By pairing credible functional ingredients like melatonin, L-theanine, and GABA with irreverence and design that feels more like a nightlife brand than a pharmacy product, then delivering it in a tab format that feels edgy and unexpected, Sleep or Die transforms the nightly wind-down into something bold and intentional. Sleep or Die is not just refreshing the sleep aid category. It is turning the nightly wind-down into something bold and current, not tired and medicinal. (Source 1 | Source 2 | Source 3)

Gamsa Foods: Oatmeal is widely viewed as a healthy breakfast staple, but most bowls rely on sugary add-ons to make them appealing, leaving a gap for tasty, convenient, and savory breakfast options. Gamsa Foods recognized an opportunity to modernize without asking consumers to abandon familiar morning habits, introducing savory oatmeal inspired by traditional Korean porridge. Each bowl blends oats with quinoa and rice, layered with bold, umami-forward flavors like sesame, garlic, miso, and seaweed, delivering the warmth and comfort of a home-cooked Korean breakfast in a format ready in minutes. By infusing oatmeal with global flavor and cultural relevance, Gamsa reopens the breakfast category to savory, culturally grounded eating in a space long dominated by sweetness and sameness. (Source 1 | Source 2)

Oddball: Gelatin snacks have long been defined by a single legacy player, beloved for nostalgia but increasingly misaligned with modern expectations around ingredients and wellness. Oddball identified why consumers were quietly walking away. It was not because they stopped loving the jiggly, playful format, but because it no longer felt worth the compromise. By rebuilding jelly snacks with real fruit, plant-based gelling agents, and cleaner ingredients, Oddball gives consumers permission to enjoy a familiar childhood ritual without the artificial baggage. In a world where indulgence increasingly needs permission, Oddball offers a way to keep the fun without the guilt. With growing retail distribution and seed funding fueling expansion, the brand shows how even the most entrenched nostalgia-driven categories can be meaningfully modernized without losing their sense of joy. (Source 1 | Source 2 | Source 3 | Source 4)

Acid League: The vinegar category has long suffered from low mindshare, treated as a commodity rather than an ingredient worth exploring. Acid League recognized that the category was quietly primed for a renaissance as interest grew in flavor complexity, functional benefits, and more creative uses for everyday pantry staples. By introducing premium, small-batch vinegars with bold, culinary-forward flavor profiles and design that feels curated, the brand repositioned vinegar as something to discover rather than simply stock. It turns vinegar from a dusty bottle in the back of the pantry into a flavor tool people actually want to reach for. As the category expands, Acid League sits squarely within a broader revival of this ancient functional food, unlocking new relevance and new usage occasions along the way. (Source)

Churn: Founded by Chef Michael Tashman, Churn offers flavor-packed, wholesome butters designed to transform any dish into a bold, satisfying moment. From Parmesan and Pepper to the sweet warmth of Maple and Cinnamon, each tub is built to be a consumer’s sous chef, a simple tool that lets anyone confidently, conveniently, and affordably elevate their cooking. The brand wins by activating at the intersection of three emerging consumer trends: demand for convenience, flavor curiosity, and a preference for wholesome ingredients. In an era of burnout and economic uncertainty, Churn gives people a way to feel creative and capable in the kitchen again without more effort. In doing so, it helps turn a basic commodity into an accessible form of everyday indulgence. (Source)

Heyday Canning Co.: Heyday taps into a simple tension: consumers love cans for their practicality, but the food inside has historically been uninspiring. The brand closes that gap by bringing creative flavor combinations and fresh-tasting, high-quality ingredients to a format people already trust. It delivers the cozy, nostalgic comfort of classic canned soups and pantry staples while pairing it with modern recipes and aesthetic packaging that feel genuinely exciting rather than like a compromise. As Heyday gains traction, including its recent launch at Target, it is helping the legacy canned food category evolve its relevance for today’s consumers. In doing so, Heyday is reintroducing an entire generation to canned food as something worth choosing, not just settling for. (Source)

Fishwife: Fishwife is infusing bold flavor and fresh energy into a category that long felt bland and overlooked in the United States. Inspired by the high-flavor tinned fish culture of Spain, the brand taps into growing culinary curiosity and interest in globally inspired foods. By pairing sustainable, ethically sourced seafood with vibrant design and modern flavor profiles, Fishwife transforms tinned fish into an affordable, everyday luxury. The brand leans into charcuterie and “girl dinner” trends, delivering bites that are delicious, nutritious, and picture perfect. Fishwife is not just refreshing tinned fish. It is attracting entirely new consumers and redefining what canned seafood can represent in modern food culture. (Source 1 | Source 2 | Source 3)

Lume: Born from OB-GYN Shannon Klingman’s experience with countless women raising concerns about body odor below the belt, Lume has reshaped expectations in deodorant by leading the charge on whole-body odor care. From traditional sticks and sprays to creams, cleansing washes, and wipes, Lume takes a different approach by acidifying the skin to block odor before it starts, using mandelic acid instead of aluminum or harsher, irritating ingredients. The brand also takes an unapologetic approach to education and destigmatization, openly talking about odor on social media in a way no one else in the category does. In doing so, Lume expands deodorant from a single-use product into a broader personal care category built around whole-body confidence. (Source)

Kevin’s Natual Foods: Kevin’s did not just modernize frozen and refrigerated meals. It permanently changed what consumers and retailers expect from the category. Before Kevin’s, convenience meals were synonymous with compromise: heavy, artificial, and nutritionally suspect. Kevin’s proved that ready-to-heat could be clean, flavorful, and genuinely aspirational. Built on sous-vide preparation and real culinary flavors, the brand unlocked a new consumer truth: busy people no longer accept “good enough” food. Kevin’s explosive, unicorn-level growth forced retailers to re-architect the frozen aisle, making space for premium, chef-driven entrées and catalyzing the “fancy frozen” movement now sweeping the category. The brand’s 2023 acquisition by Mars is not just an exit story. It is evidence that Kevin’s successfully reset the economics and expectations of convenience food, pulling an entire category into a more premium, health-forward future. (Source 1 | Source 2)

Chomps: Meat snacks carried baggage: perceived as over-processed, nutritionally suspect, and limited to a narrow consumer base. By rebuilding meat sticks with simple ingredients, clear quality credentials (100% grass-fed, Whole30-approved), and elevated packaging, Chomps made meat snacks feel modern, trustworthy, and approachable. The brand even leans into category stigma with self-aware messaging, “all the stick without the ick,” helping disarm skeptics and invite first-time users into the set. Chomps has already shifted the category’s center of gravity. Roughly two-thirds of its consumers were new to meat snacks before discovering the brand, helping establish clean-label protein as the new baseline for what meat snacks should be. Now one of the fastest-growing food brands in the U.S., Chomps is not just benefiting from category momentum. It helped create it. (Source 1 | Source 2)

Implications for All Brands

The challenger brands in this year’s study show how the challenger mindset has evolved. Across categories, these brands are actively reviving familiar categories and redefining what they stand for, and reimagining what they can become.

Even the most established categories can be reignited with the right insight and conviction. Because the strongest challengers do not just grow themselves, they help shape what comes next for the entire shelf.

As always, we would love to hear from you. If you would like more information on any of our challenger brand studies, or want to share a brand of your own, please reach out at info@seuratgroup.com.