Modern Price Pack Architecture

Modern Price Pack Architecture

Reframing Innovation: Why PPA Deserves Center Stage

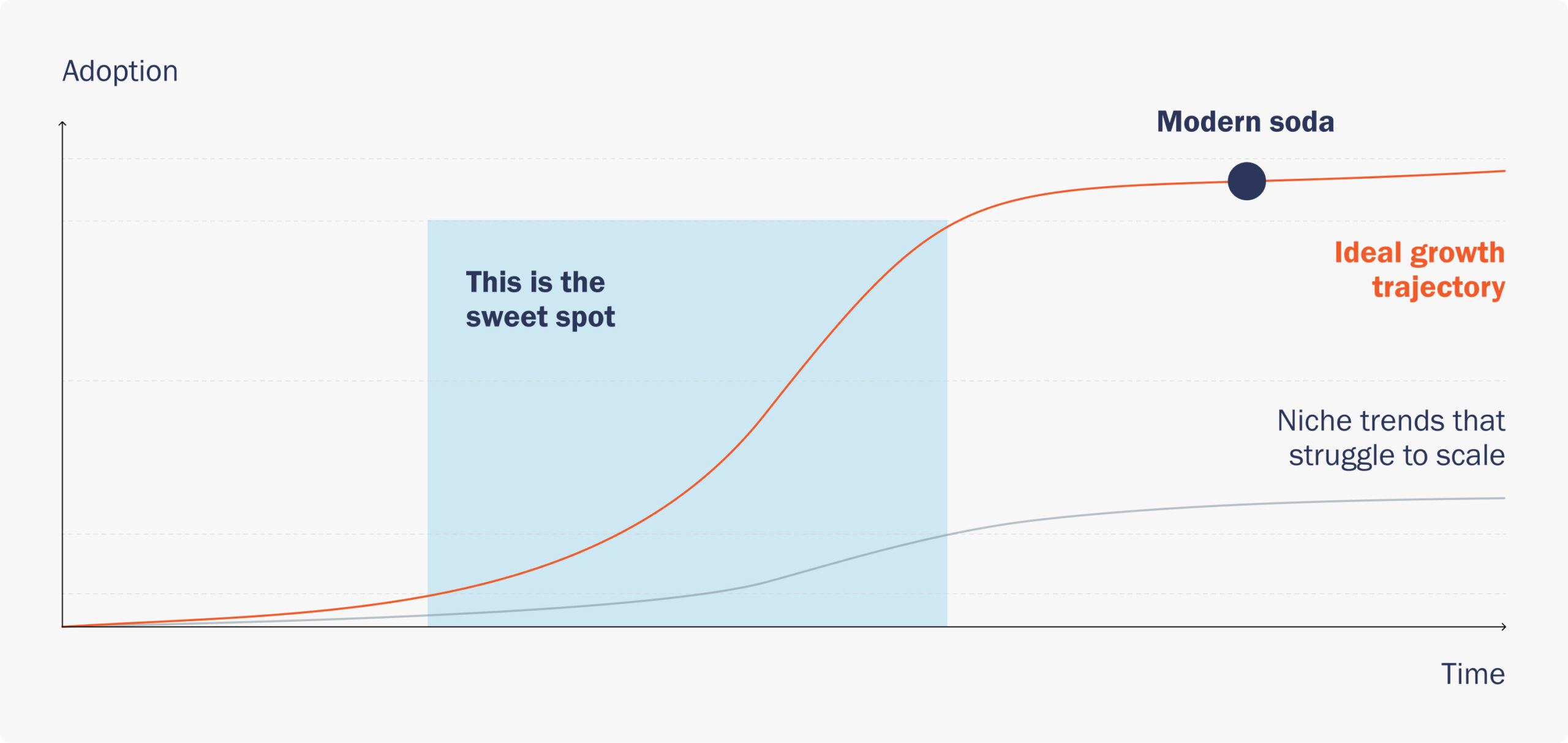

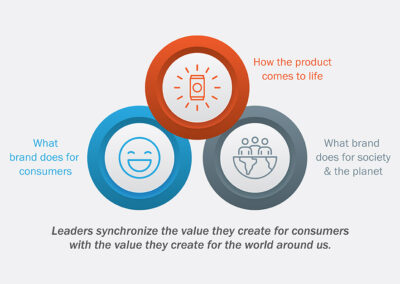

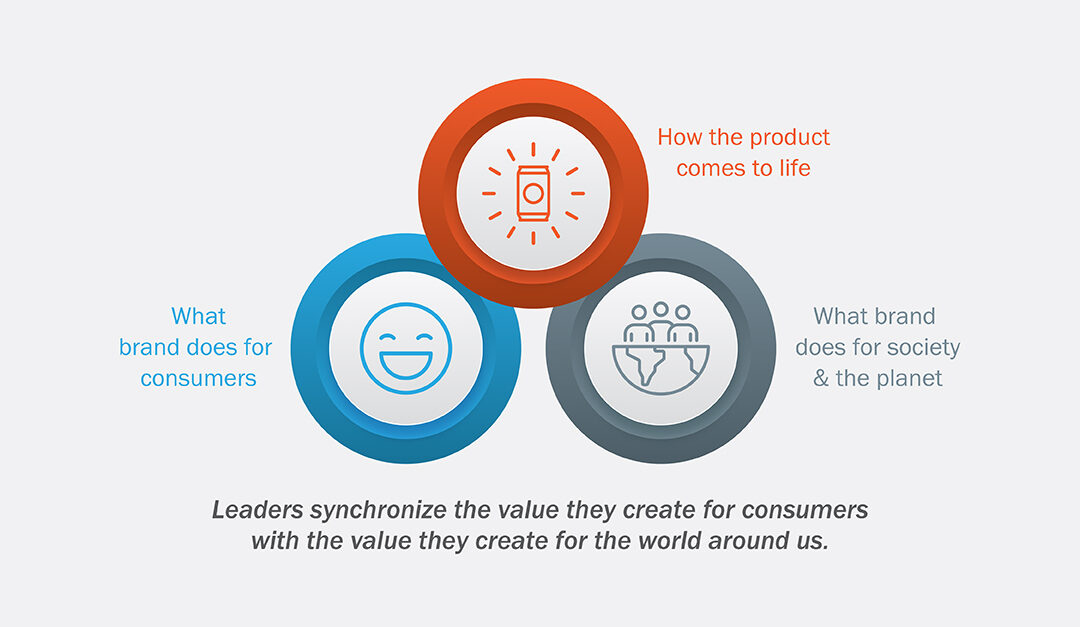

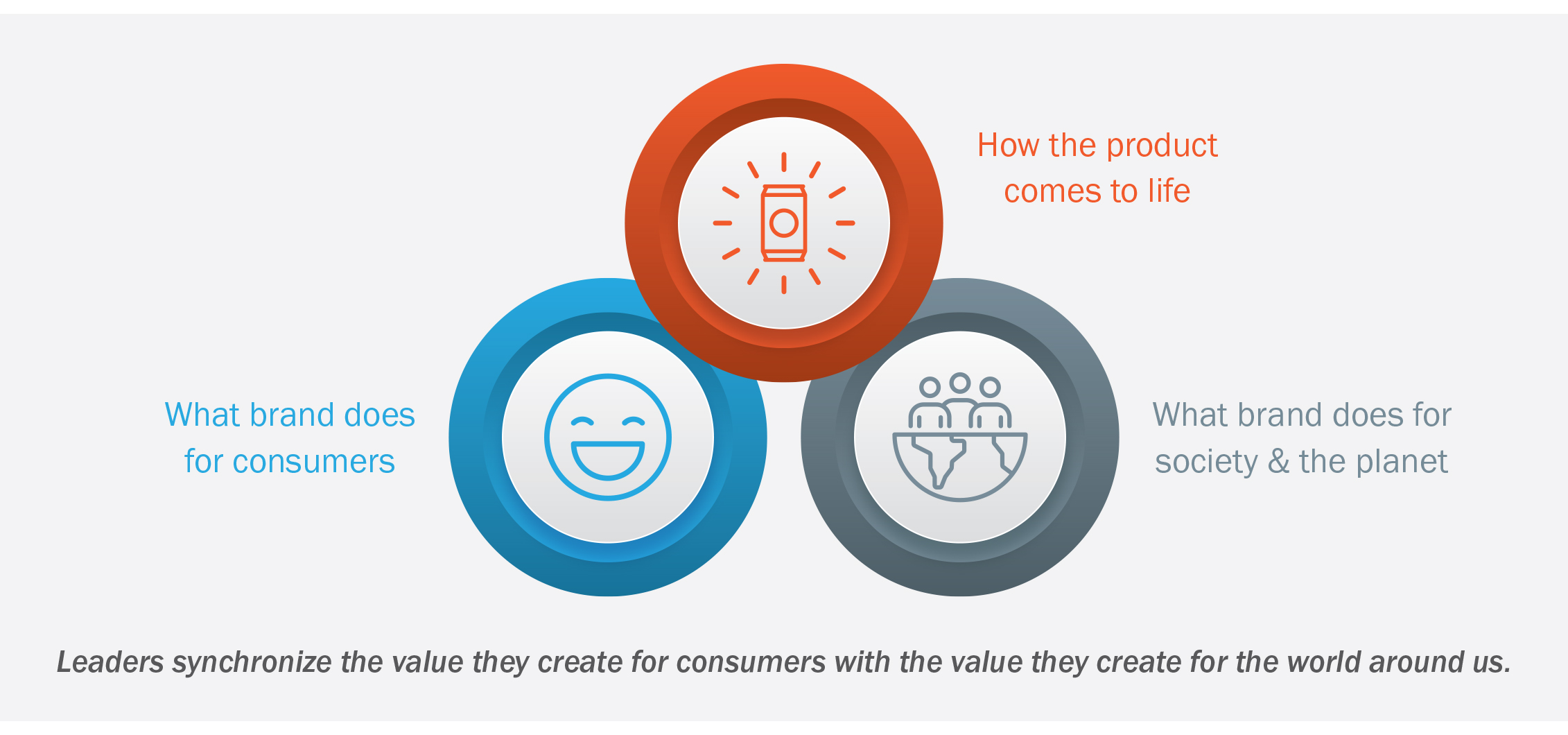

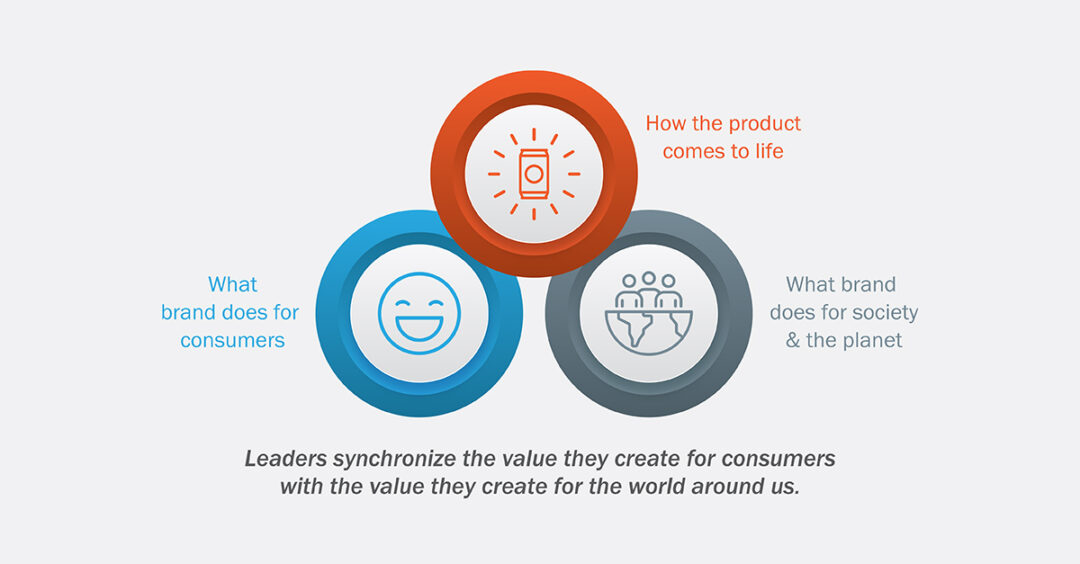

Innovation is often defined by the new: new products, new categories, new platforms. But the most powerful innovation today doesn’t just disrupt — it deepens the relevance of the brand for the consumer.

Price Pack Architecture (PPA) has been used as a core element of channel management and omnichannel strategy for some time. PPA shouldn’t be solely utilized to reactively patch category gaps and manage channel conflicts. That mindset underestimates its growth potential. Rather, PPA should play a central role in marketing and commercial strategy.

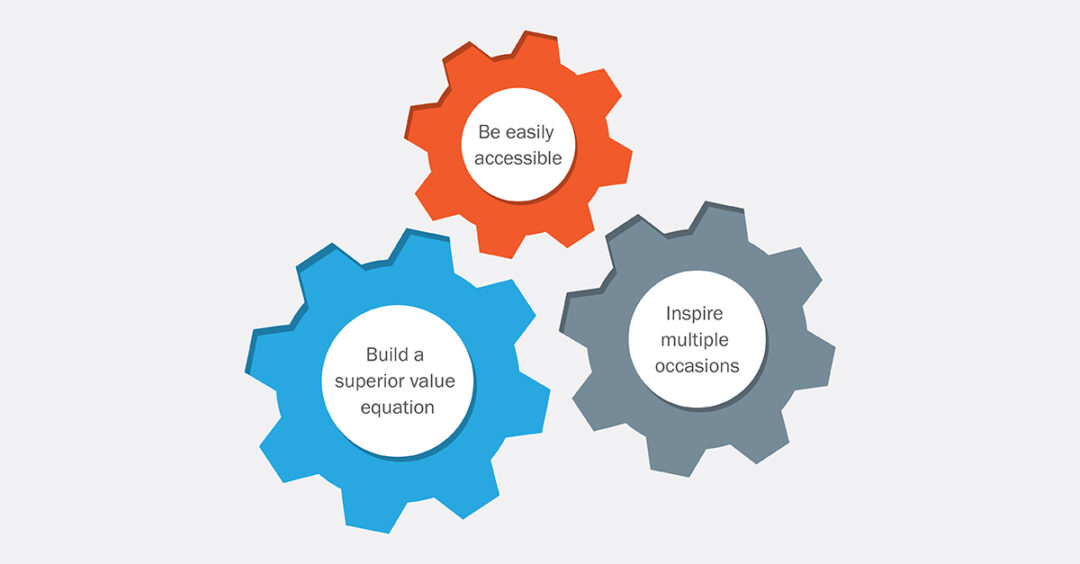

In today’s environment, we believe PPA is a more efficient form of innovation that scales what’s already working to build the brand, rather than place riskier bets on ‘what’s next.’ It’s a strategic marketing lever that works across the marketing funnel to acquire new users, capture more usage, and efficiently create brand and category value. Done right, it can serve as one of the most efficient, scalable growth tools in the brand toolkit.

Why PPA Matters More Than Ever

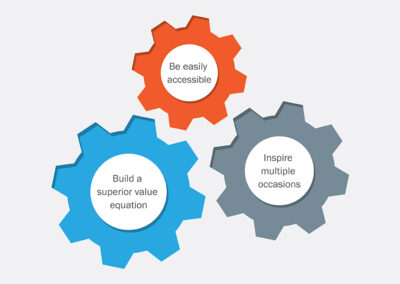

The market is changing, and so is the way consumers and shoppers engage with brands. With the proliferation of touchpoints and the rise of omni-channel media, shoppers are more inundated with messaging than ever before. In this ever-changing context packaging can be a constant that plays an instrumental role in building physical availability and visibility.

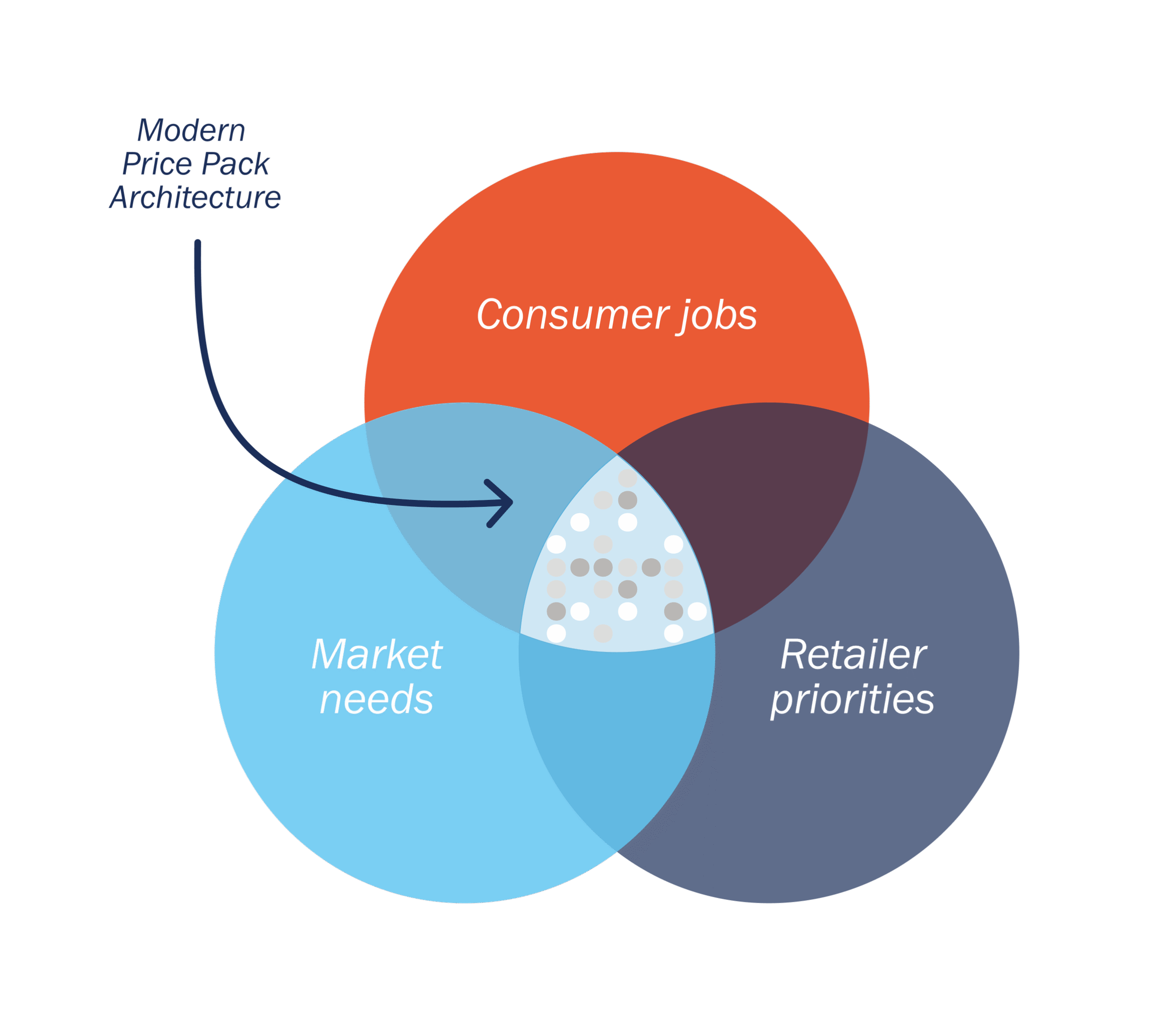

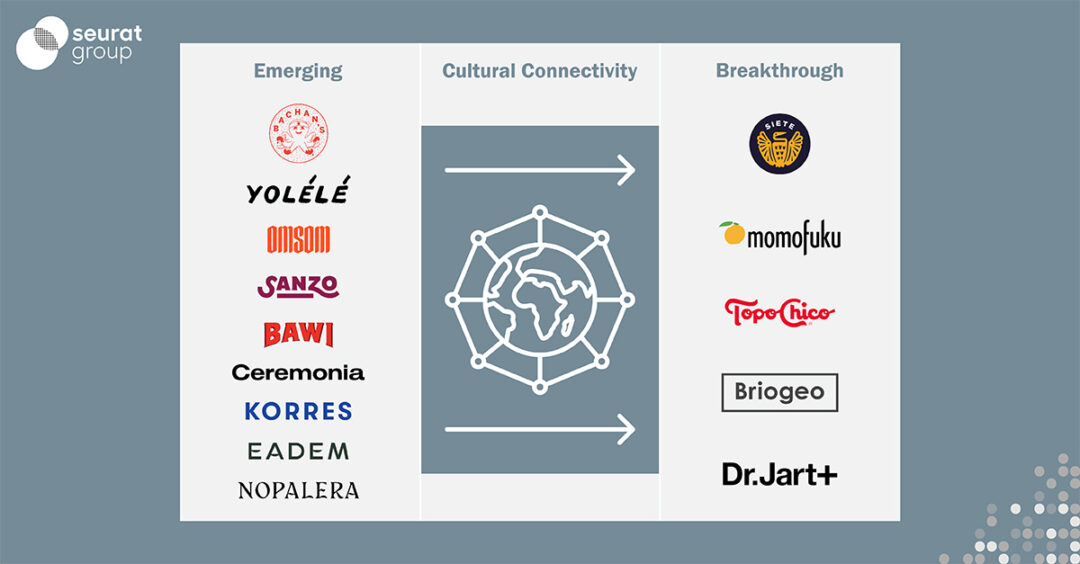

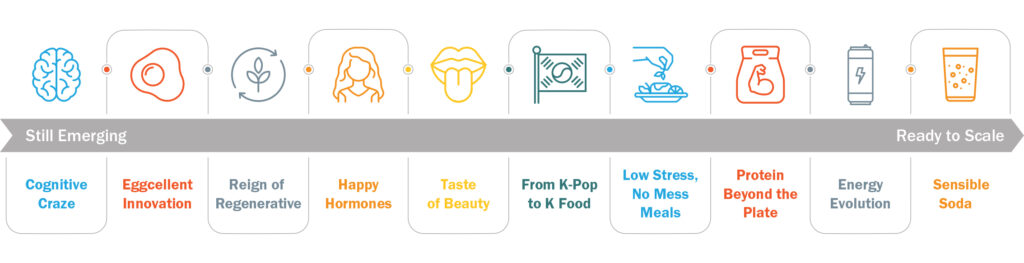

Consumers are demanding products that address specific micro needs — whether it’s on-the-go-snacking, a mid-afternoon reward, a morning boost of energy or a host of other daily needs. At the same time, Retailers are prioritizing personalization, shelf efficiency and formats that enhance margin and fit tight space parameters. Ecommerce has redefined discovery, favoring trial-friendly, visual-first, and value-packed SKUs. These trends put pressure on brands to ‘show up’ in increasingly different ways to delight consumers and retailers.

In this context, PPA isn’t just about incrementality, it’s about relevance. It lets brands grow without overextending, building from their position of strength instead of chasing what’s simply new and novel. This strength comes from PPA’s ability to deliver on diverse consumer and retailer ‘jobs’ alike in a way that is much more targeted and unique. PPA helps consumers more effectively address a wide range of needs, while helping retailers achieve shopper goals and drive incremental growth in-store and online. From big CPG to Challenger brand, and across all categories, PPA makes existing products more valuable, more shoppable, and more discoverable, which unlocks more growth.

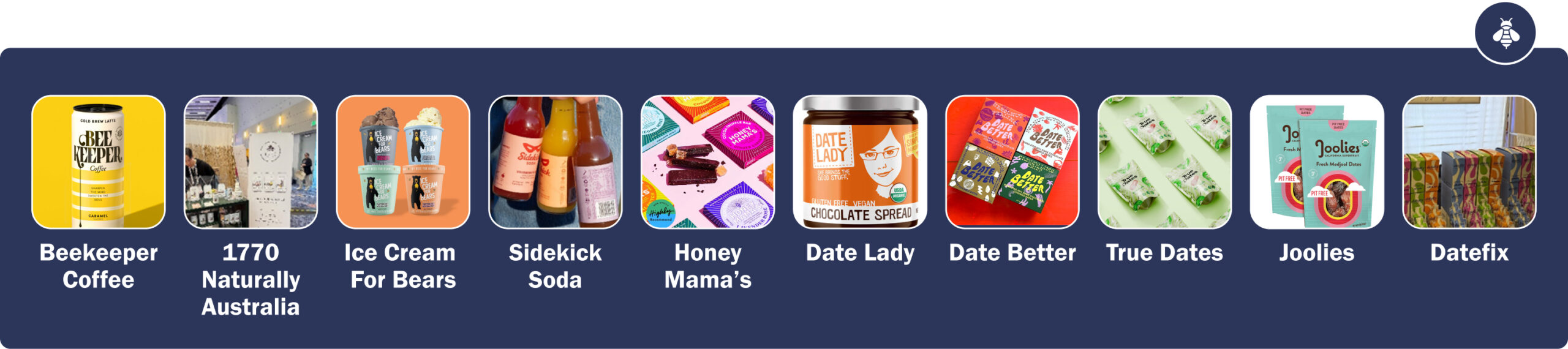

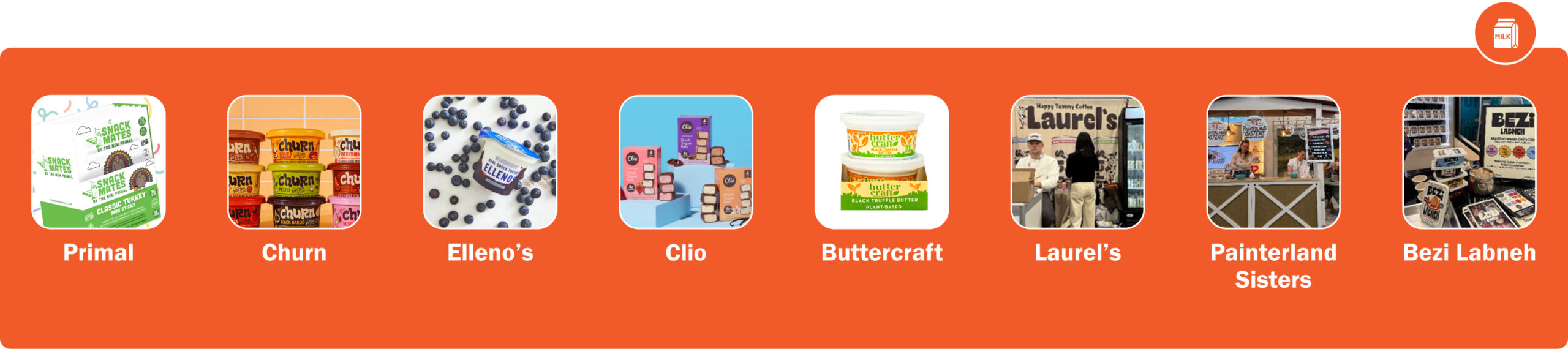

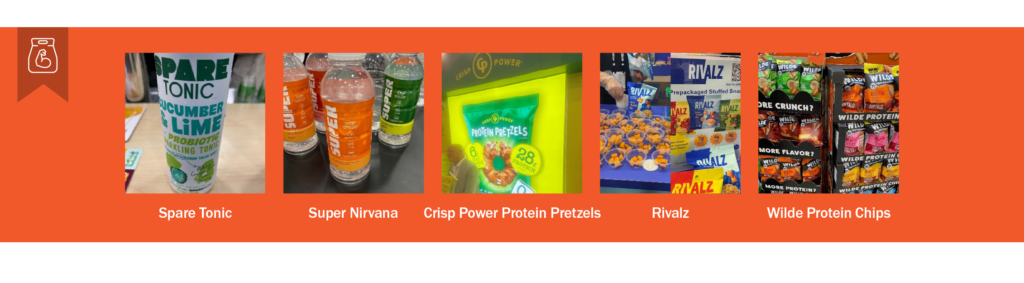

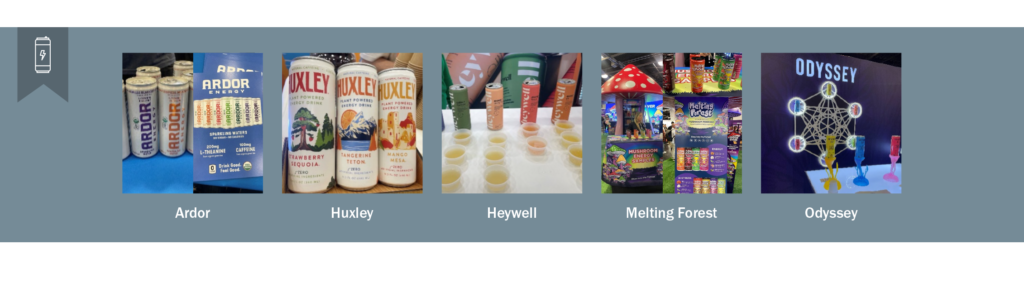

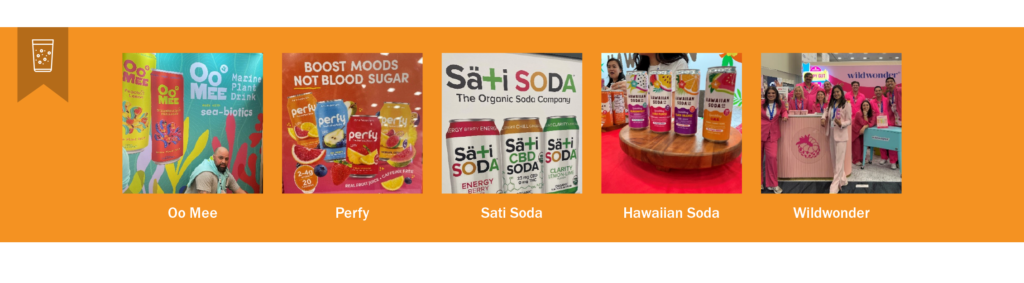

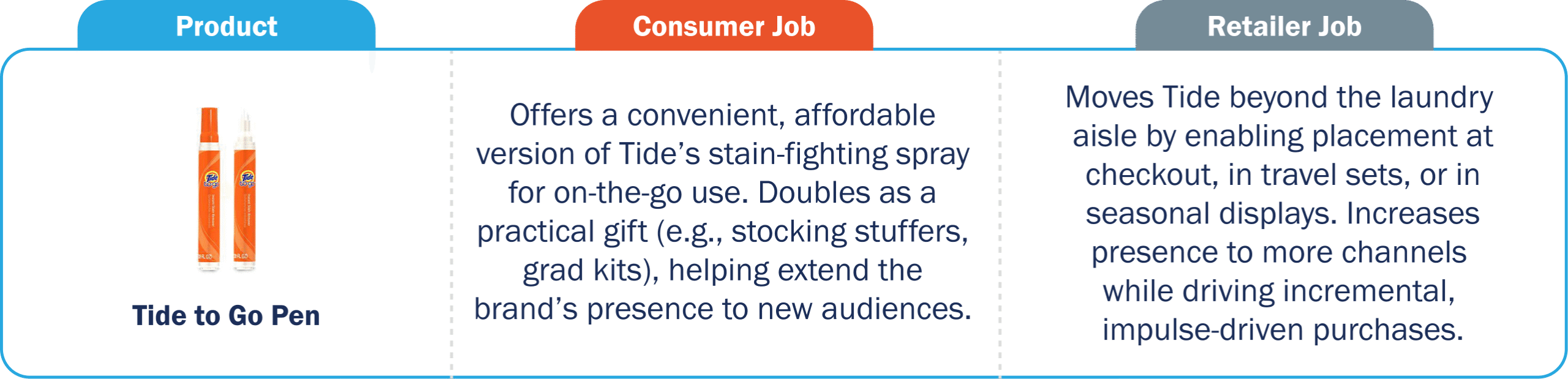

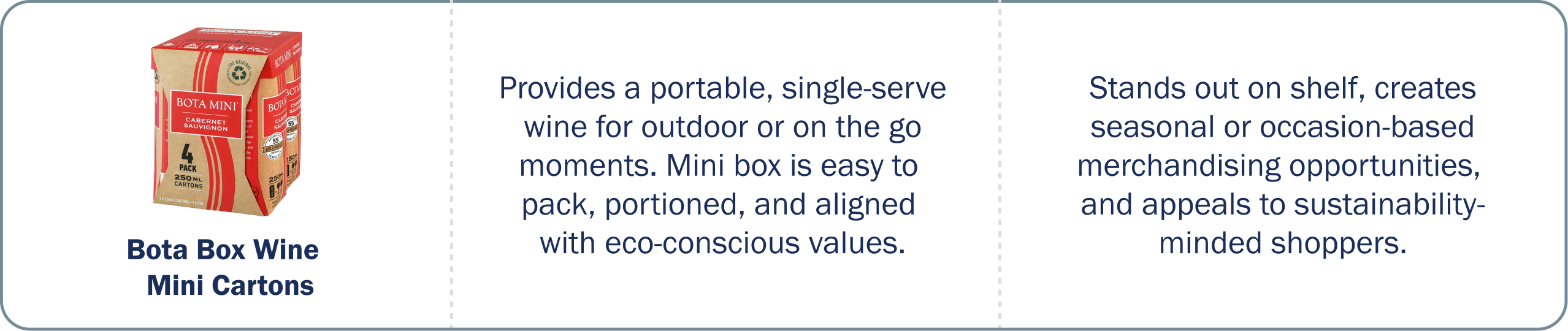

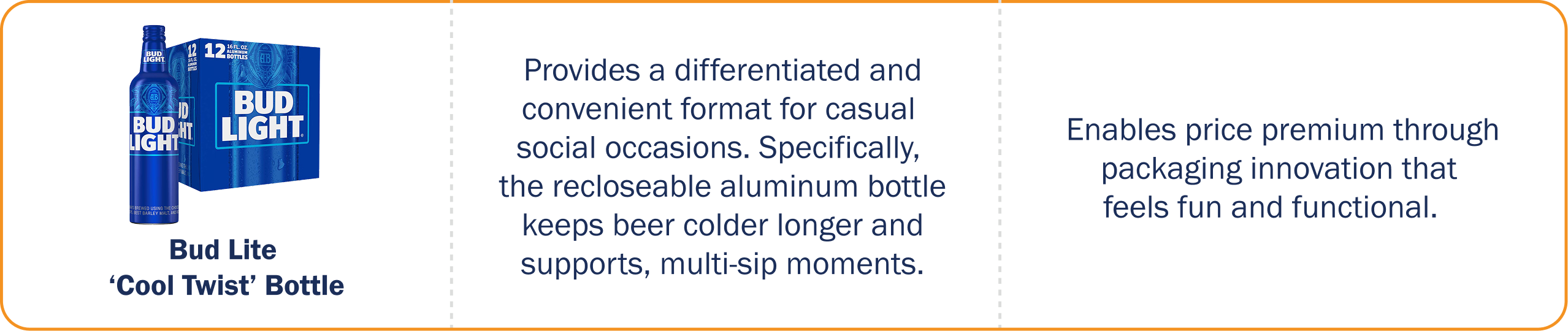

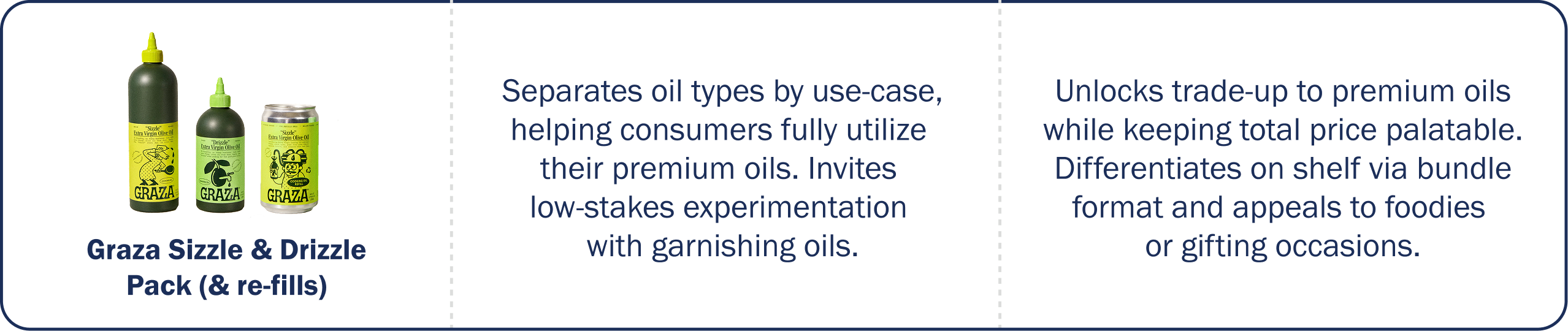

Below, we’ve highlighted 5 brands in different categories that leveraged PPA to fulfill retailer and consumer jobs simultaneously.

How to Leverage Insight to Build Smarter PPA Strategies

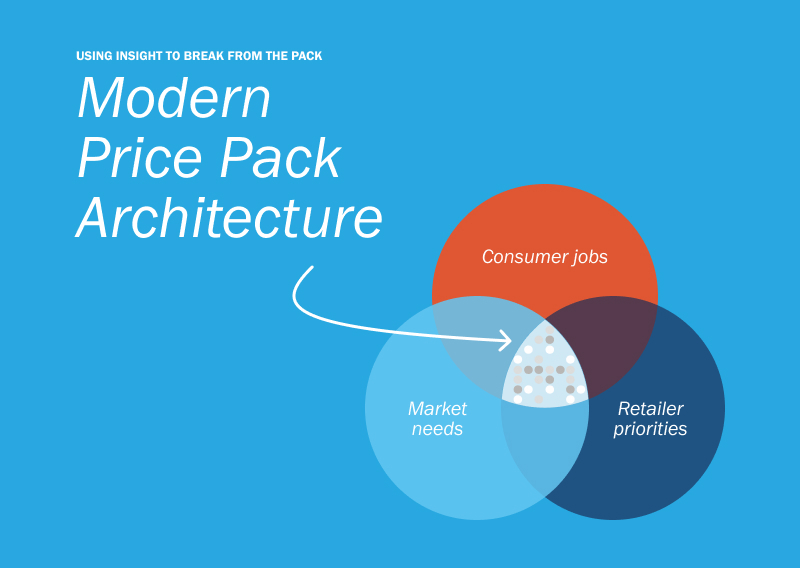

Today’s Price Pack Architecture doesn’t start with format, it starts with insight: understanding what consumers need, what retailers prioritize, and where the brand can stretch to win.

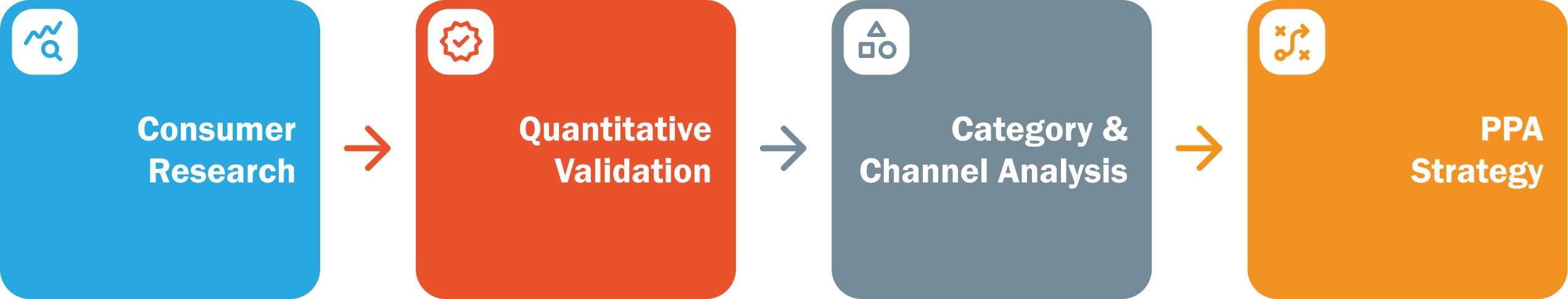

Immersive consumer research, based on strong hypothesis development, is critical to reveal the ‘why’ behind behaviors—uncovering unmet needs, friction points, and rituals that brand can solve through PPA.

Quantitative validation confirms the scale and impact of these needs and opportunities, ensuring that pack-led solutions are backed by data and have potential for broad adoption.

Category and channel-specific analysis must be layered on to ensure PPA strategies are grounded in retailer needs and real-world retail dynamics.

Together, these insights create a sharper, more strategic approach to PPA. This approach balances consumer relevance with retailer fit to unlock incremental, sustainable growth.

Embedding PPA into Business Planning

To turn PPA into an incremental growth lever, brands must identify opportunities and develop strategies upstream, embedding it into the annual business planning process as part of marketing and innovation plan development.

The process above should also be part of the learning and research plan to clarify the consumer moments, shopper missions, and barriers that pack architecture can address. Without a strong insight foundation, solutions risk being built around standard formats rather than quantified opportunity.

And finally, success should be measured not just by immediate incrementality, revenue or lift, but by how many moments, missions, and baskets a format can serve.

If you’re exploring how to embed strategic price pack architecture into your annual planning or want to trade thoughts on how PPA can unlock growth, then we’d love to connect. Please reach out to info@seuratgroup.com to continue the conversation.