Radical Price Transparency

The growth of ecommerce and proliferation of new marketplace models is having an outsized impact on how manufacturers and retailers manage price and promotional spend. Algorithmic price matching ensures that online retailers always offer the lowest marketplace price and provide the best value to their shoppers, but increases the risk of a “race to the bottom” for unsuspecting brands. As Amazon and other Omni – channel retailers build their consumables offer, the risk to mainstream manufacturers will continue to grow in the form of eroded brand value and commoditized categories.

The Impact: With trade rates increasing faster than sales, trade continues to be a place where manufacturers turn to enhance the value equation offered to consumers, make up for gaps in price architecture and address pressure from retailers to improve their sales and profit.

We at the Seurat Group believe there is a widening gap between today’s approach to trade promotion and rapidly changing Omni – channel market dynamics. There is an opportunity for manufacturers to use their trade program structure more strategically to deal with the coming change.

Radical Price Transparency

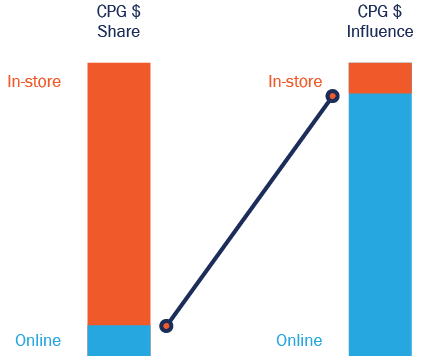

The Seurat Group believes this alarming trend – what we call “Radical Price Transparency” – is at a critical inflection point and manufacturers need to reorient how they think about trade and price architecture. While many manufacturers still feel insulated from the impact of ecommerce – given that online CPG US dollar sales hover around 2% – we believe the impact of these models extends beyond share of category. The share of price influence and perception driven by online platforms far exceeds today’s dollar share. Brands need to prepare for the continued shift of both dollar and price influence share online.

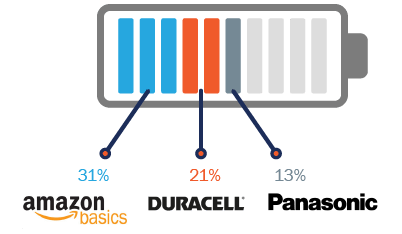

Batteries eCommerce Brand Share ($)

This issue of “Radical Price Transparency” is highlighted in the case of Batteries. The commoditization of the category online has been driven by practices of online retailers like Amazon. Scraping data across channels and exploiting imperfections in price architecture, Amazon Basics (Amazon’s PL line) catapulted to the #1 battery brand online while reducing total category price per unit across channels. This highlights the ability of Amazon to expose architecture imperfections and commoditize categories by effectively leveraging pricing data.

Solution

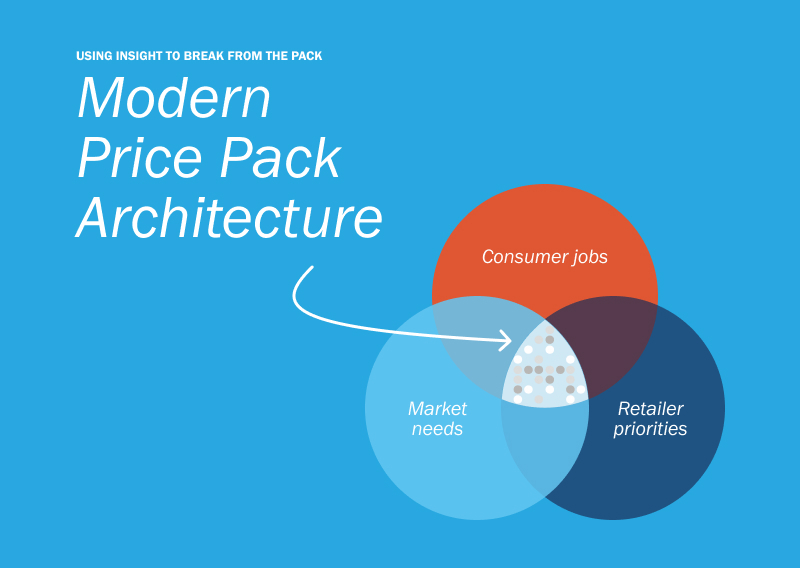

The Seurat Group recently conducted a survey of 40+ CPG Manufacturers on their trade management practices and identified 3 core solutions to help address the impact of Radical Price Transparency.

Conclusion

Radical Price Transparency is the new-normal in CPG. As manufacturers continue to drive trade and pricing efficiencies, and as ROI-positive events are harder to come by, there needs to be a shift in how trade programs are structured to combat this new reality. Instituting an outcomes based program with strong policies & controls, smart discounting & an Omni-channel pricing architecture improves profit and alleviates the increased risk of commoditization from ecommerce. For more information on trade capabilities, pricing strategy, or if you would like to participate in our upcoming 2018 CPG Manufacturer Trade Survey, contact us at info@seuratgroup.com or visit our website SeuratGroup.com.