MyClickstream: Connecting The Dots in Your Omnichannel World

Omnichannel Missing Link

Today, only about 1% of Consumer Packaged Goods sales are online. By 2018, that number is estimated to be 5%, with a full one-half of CPG growth estimated to be from online purchases.

Small brands are winning disproportionately online, gaining shoppers and engagement that can be parlayed into an in-store threat. For example, of the top 5 shampoos on Amazon.com, only 2 are available in brick & mortar retailers.

Winning online requires understanding the shopper’s full path-to-purchase in the increasingly omnichannel environment that shoppers are living in today.

Do you know how your shoppers are behaving online? Do you know whether those searches end up as purchases online or offline? What retailer they end up purchasing from and why? Is it better to invest in images, product detail content or in search? How does this differ between Amazon.com, Target.com, and Walgreens.com?

Manufacturers and retailers have expended significant resources toward understanding how shoppers are behaving and navigating in-store, but that same effort has lagged online.

This is because information on how to do this is limited, and manufacturers are hesitant to invest when approach and outcome are unclear.

Nevertheless, the time to understand omnichannel behavior and develop a winning strategy is now, before smaller, challenger brands take a permanent lead.

Limited Options Today

Few solutions exist today to fully understand and take targeted action against shopper behavior in order to grow brands online.

Current options rely on getting data from ecommerce platform owners, buying historical metrics from an online panel company, or conducting your own primary research by asking shoppers to recall purchase behavior and decisions.

Each one of these approaches comes with drawbacks around accessibility, flexibility, or accuracy. As a result, brands still lack the ability to develop a 360o view of their shoppers’ paths to purchase online and turn that into a truly differentiated omnichannel growth strategy.

The time is right to close this gap and begin to truly understand and anticipate shoppers’ changing needs. Doing so will provide the information needed to:

With the limited resource environment that most brands are living in, it’s critical to understand which elements online are driving shoppers to your brand.

Are they searching for your name or for your category? Are shoppers reading product content or reviews? What behaviors mark someone who buys your brand versus your competitors?

With the limited resource environment that most brands are living in, it’s critical to understand which elements online are driving shoppers to your brand.

Are they searching for your name or for your category? Are shoppers reading product content or reviews? What behaviors mark someone who buys your brand versus your competitors?

Find out what shoppers are searching for online and what they are browsing for that they can’t find or how they are being satisfied by your competitors.

Understand what shoppers react to positively and negatively online, and what marketing levers are more likely to lead to conversion or trade-up.

How to Connect the Dots in Your Omnichannel World

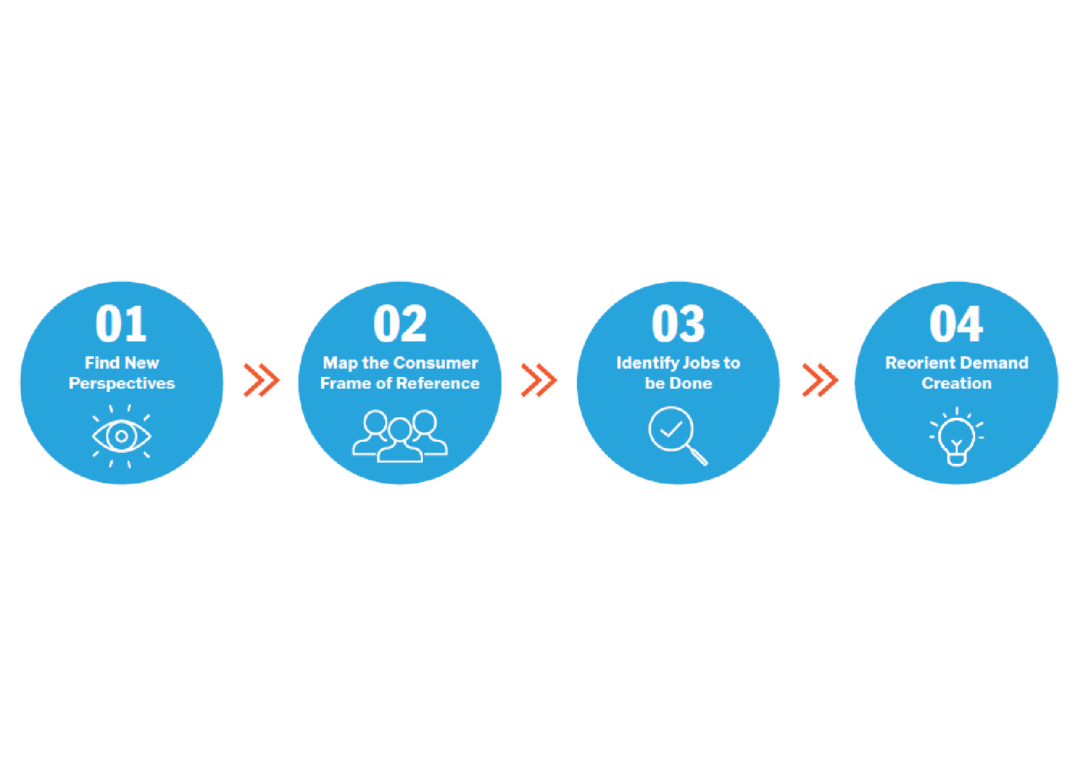

Closing these gaps requires the right custom data and approach to capture both what shoppers are doing in a specific category and why they are doing it.

Seurat’s myClickstream methodology gathers and integrates disaggregated data across the entire path to purchase. With this capability, we are able to answer a dizzying array of questions about shopper actions and motivations, ultimately allowing you to influence shoppers at the point of purchase by offering them the right solution in the right place at the right time.

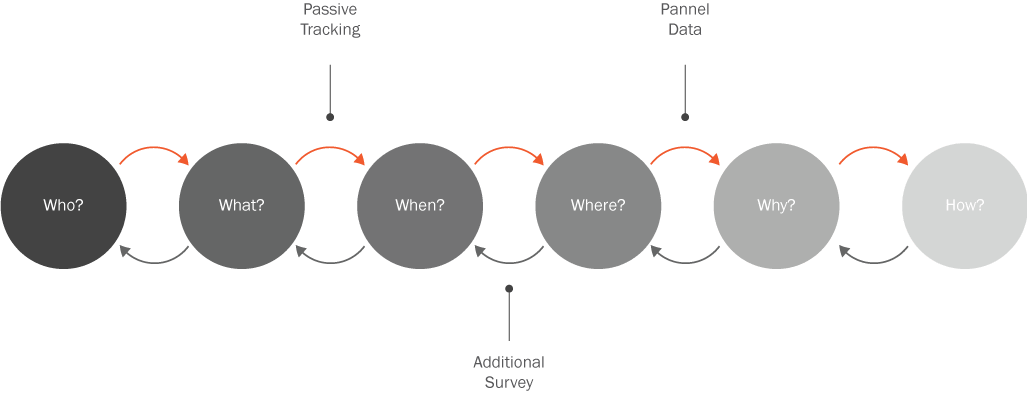

Each of the three complementary data sets plays a unique role in understanding the shopper:

Shoppers download an app to their computer, tablet or phone, which captures every URL they click on.

These same shoppers in a panel share their purchase receipts in brick & mortar and/or online with us.

Shoppers take an attitudinal survey, allowing us to understand motivators: why they behave in the ways exhibited from passive tracking and/or purchasing data.

Through these three steps, we are able to understand

shopping missions and retailers chosen, navigation and trip missions, purchase decisions, and drivers/motivations to purchase across brick & mortar and ecommerce.

Being able to link this data at the household level enables deeper understanding of how online behaviors convert into purchases on and offline and can be used to generate actionable insights that will trigger desired shopper behaviors. Additionally, this dataset is owned by you, enabling greater depth and flexibility of learnings.

This engine can be continuously mined to dig deeply to uncover new, compelling insights as new questions and needs arise. This ownership and deep level of detail enables you to engage in a highly customized way with your categories, your customers, and your shoppers.

The breadth of learnings achievable through myClickstream can be used to derive custom insights from the data to

arm the entire demand plan, ranging from customer and category planning to omnichannel leadership to capability development and marketing activation.

Contact us at info@seuratgroup.com or (203) 774-4900 to learn more about including MyClickstream to build your business online.