Embracing Private Label To Drive Own Brand Growth

Overview

As private label investment and share climbs, manufacturer brands will need to adapt new strategies for success and challenge the conventional approach of fighting against private label. Yesterday’s toolbox of managing price gaps and pursuing assortment and shelving optimization is no longer

the playbook for success. Manufacturers that are able to embrace private label’s role in the category, while clearly defining the incremental value that their brands bring to the category, will position themselves for true success in a growing private label world.

From Search

Private Label is an attainable, proven, profitable growth strategy across all retail channels. In an environment that is increasingly difficult to take price and grow share, retailers have chosen to aggressively pursue profit and sales growth through more sophisticated store brand strategies.

They are turning to private label to capture 25-30% higher margins, meet their consumers’ needs and provide unique offers that can create a compelling differentiation to drive traffic and loyalty.

Store Brands Have Momentum

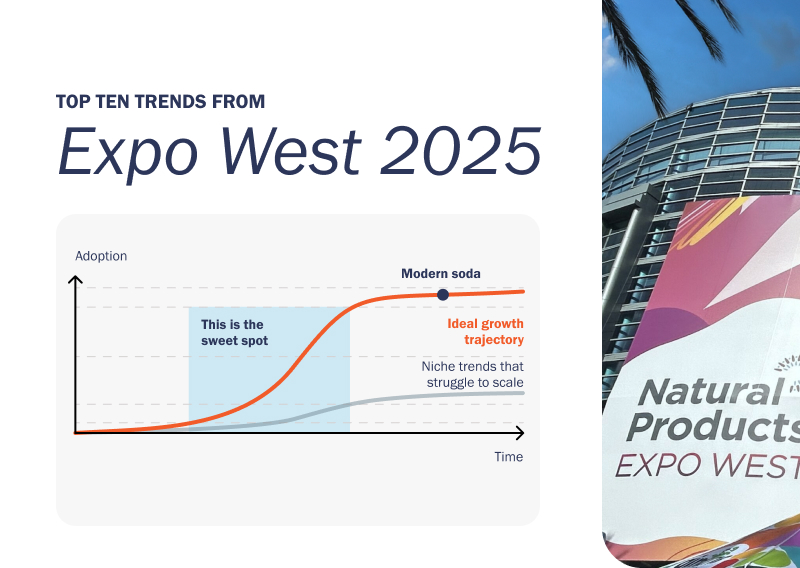

Retailers have made significant strides in the effectiveness of their store brand portfolios, contemporizing the branding, innovating the assortment, and offering more services.

No longer is private label known as a generic or the ‘off brand.’ Today, retailers are fast to innovate and exploit new trends, in many cases leading innovation in categories.

Private Label is capturing share across channels, from Grocery and Natural channels to E-Commerce to Mass Merchandisers. Momentum continues to build.

The Case for Private Label Focus:

Retailers Face Declining Profits:

In an environment that is difficult to take price, retailers must take margin.

Economy Remains Unfavorable:

Aproximately 1 in 7 people in the US received SNAP (Supplemental Nutrition Assistance Program) benefits1.

More Consumers are Open to Store Brand:

Millennials are more likely to purchase private label as they grew up with store brands being more than cheap alternatives.

Aging generations, triggered by a poor economy, have tested and enjoyed private label. They have lived through National Brand Equivalents and Generics and are now at a point in time that they cite the highest propensity to buy private label products.

Select Examples of Private Label Momentum:

Whole Foods:

Whole Foods:

Creating a new store format focused on value, and own brands to lower the cost of natural living

Meijer :

Meijer :

Meijer launching ‘True Goodness’ brand which offers products that are free from artificial flavors, colors and preservatives at an affordable price

Kroger:

Kroger:

Developed 3 new private labels to better meet a broader range of shopper needs: ‘p$$t’, ‘Heritage Farm’ and ‘Check This Out…’ – Simple Truth reached $1.2B in sales during 20142

Walmart:

Walmart:

Partnered with Ree Drummond – blogger, cookbook author and host of her own Food Network TV show – to create ‘The Pioneer Woman Collection,’ a line of modern country housewares exclusively sold at Walmart

Today’s Principles to Successfully Win Alongside Private Label

The following five principles represent the new ways to manage your branded business with the growing momentum of private brands in your categories.

They require Manufacturers to think differently to better partner with retailers through their private label, and to drive sustainable growth for the category and your brand.

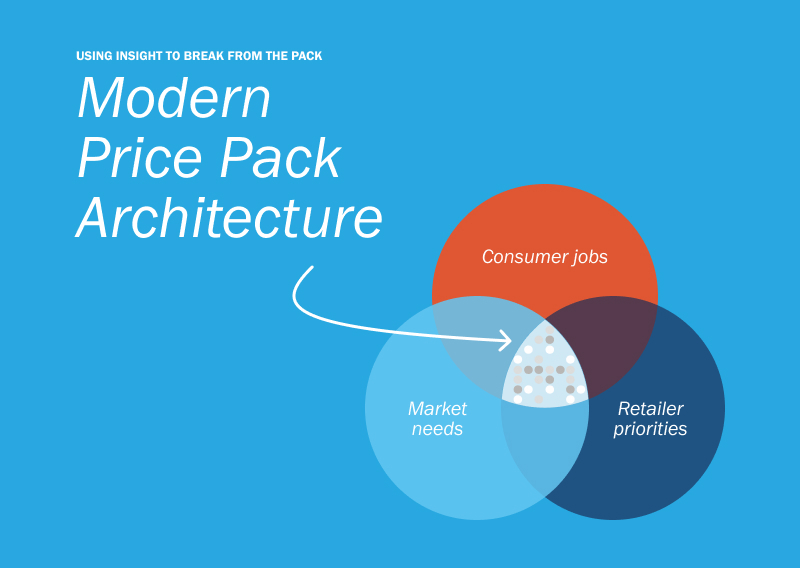

Every retailer wants to know where the category is heading. Having a vision on where the category is going, the incremental value available, and the roadmap to get there, enables manufacturers to provide significant value beyond the category manager’s capability.

Communicating a clear understanding of the category dynamics and a vision for where it is going tomorrow is critical to lead planning and guide the role of private and leading Manufacturer brands.

Become the go-to partner for identifying whitespaces and innovation pipelines, educating shoppers, improving the in-store experience, and curating targeted messages that help your brands, private label, and the category grow.

While retailers are refining their ability to market to consumers outside of the store, the strength of national brands is their marketing capability. Bring demand beyond what a retailer can create.

Staying top of mind and relevant with today’s consumers is critical. Authentically reach out to your retail partners’ marketplace to develop a strong personal connection that continually motivates purchase.

Create Category Demand In-Store with Disruptive Merchandising beyond PL Capabilities:

In-store remains a critical battleground for your products. Although shoppers are rushing around on their usual route through the store, shopper’s are continually interrupted by new items, displays, sales, education at shelf, etc.

Seize the opportunity by grabbing the shoppers attention. Create demand for the category through various in-store levers beyond a retailer’s programs.

One in five shoppers say they impulsively buy categories that they had no intention of purchasing prior to entering the store, while 28% claimed to make their brand decision in-store.

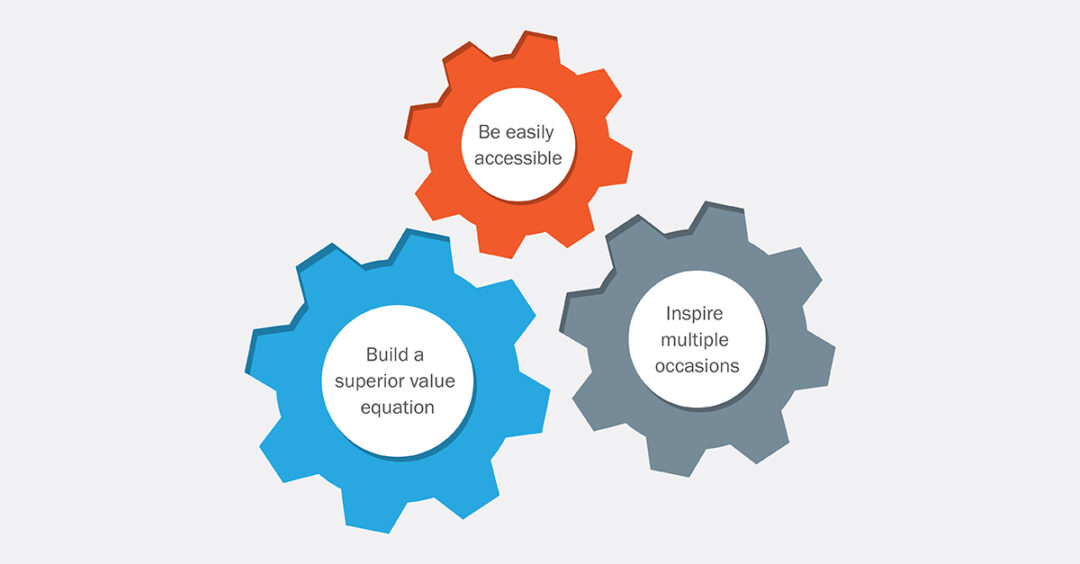

Use Retailer Momentum to Optimize Brands as Part of the Category Strategy:

Be the Partner that helps retailers build private label share and capture more of the market. As private label reaches more shoppers, leverage its success to rationalize competitive brands, and focus on efficient assortment strategies (i.e. 2 or 3 brand strategies).

Working together, private label can capture ‘quality at a value,’ and the leading national player can provide incremental sales through ‘value added’ items.

Build a Price Value Benefit to Help Retailers Capture Lower Tier Shoppers:

How value is defined varies from shopper to shopper, and willingness to pay rapidly changes as new benefits are introduced to the market.

For manufacturers, it’s not about low cost, but meeting a need at a lower price point. While private label can stand for ‘quality at a value,’ national brands need to embrace the value tier by having a competitive offer that is appropriately supported – driving branded sales, but also helping retailers gain a bigger share of the growing value segment.

Conclusion

The above five principles require a holistic approach to the category, your consumer, and your customer. To play better alongside private label, national brands must have a view on where the category is going, provide incremental value both out of store and in store, and embrace the value tier to win share for themselves and the retailer. The retail landscape has changed, and to be successful national brands need to re-establish their position, including how to best fit with the retailer’s assortment and their consumers’ needs, while continuing to leverage their greatest asset – flexing their marketing muscles to generate demand for the category.