The 7 Wonders of College Dining

The 7 Wonders of College Dining

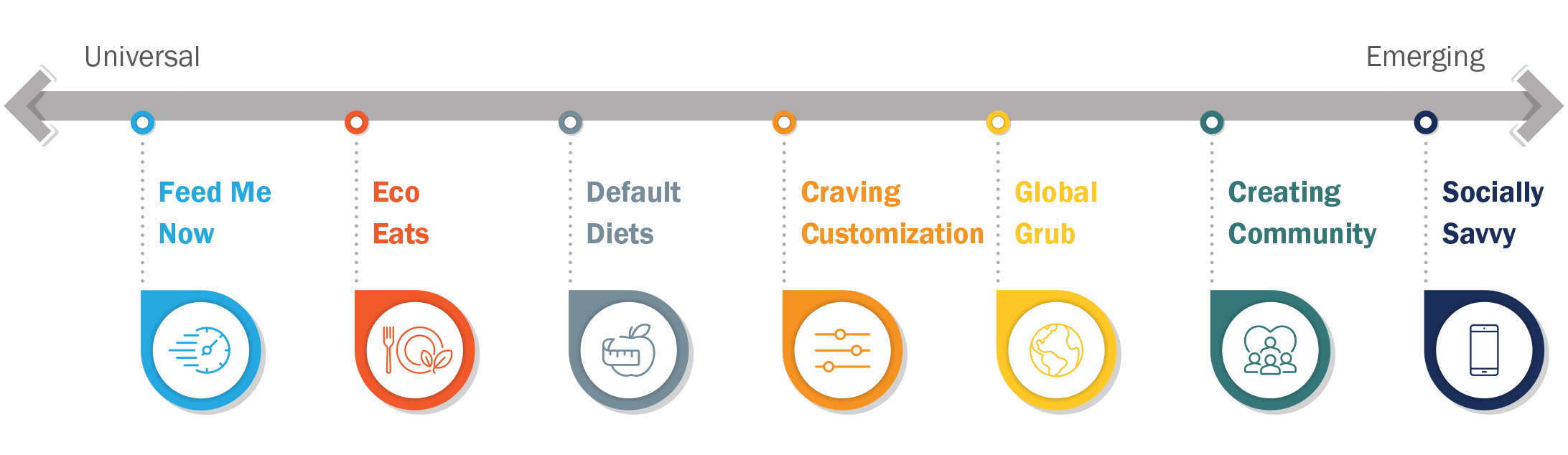

Understanding Gen Z dining trends to drive growth in retail

Gen Z consumers are entering peak college years, and while this demographic already has tremendous purchasing power, that will continue to grow as they gain independence and enter the workforce. As a result, meeting their needs has become essential for brands across categories. This generation is also extremely focused on education, with 84% of Gen Z consumers planning to go to college. As the first time many of them gain significant independence and make purchasing decisions without having to work through their parents, college becomes an effective window to understand what truly matters to Gen Z consumers and what they will prioritize as they enter adulthood.

While these students are busy learning about the 7 wonders of the world in their gen. ed. classes, we’ve studied their food trends to identify the 7 wonders of college dining.

Prevalence in On Campus Dining

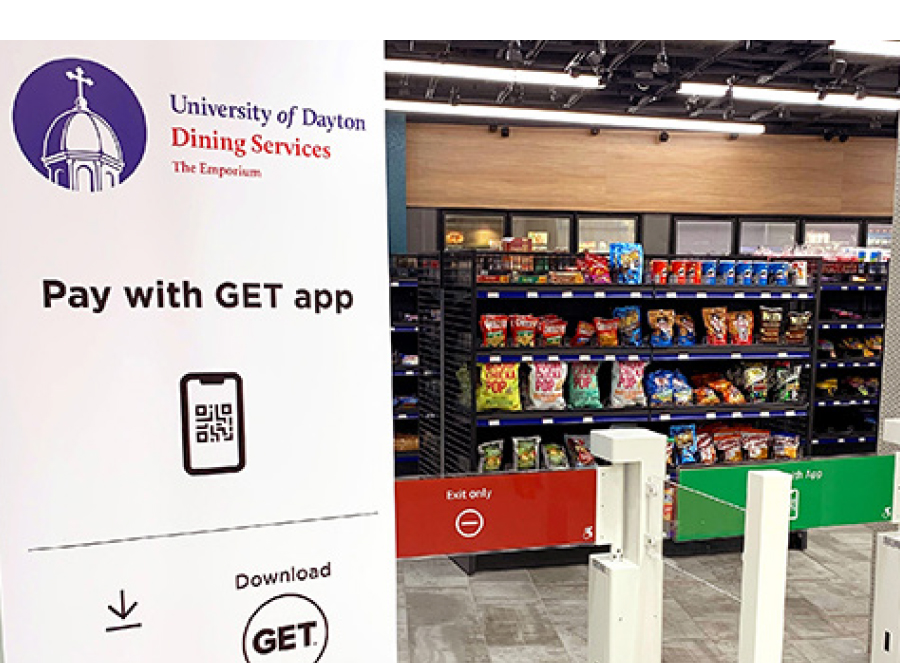

Feed Me Now!

Feed Me Now!

Insight

Evolving schedules, always on-snacking, and a culture used to immediate gratification means young people expect to get exactly what they want, when they want it! That means students expect good food quickly any time hunger hits (24/7).

Provocation

Fresh, high-quality, fast food 24/7 is a key need. Improving accessibility of food for anytime eating (without a lot of cooking) will be the expectation for this generation – How can we provide extreme convenience in the grocery store to allow retail to deliver and outcompete foodservice?

On Campus Examples

Eco Eats

Eco Eats

Insight

The environment is Gen Z’s number 1 concern, and they prioritize companies that authentically align with their values. From sourcing locally grown produce to embracing plant-based alternatives, they advocate for eco-friendly practices in food production, and are willing to pay a premium to do so.

Provocation

This generation’s commitment to environmental stewardship underscores the need for brands to align with these values. Embracing sustainability will help brands stay relevant!

On Campus Examples

Default Diets

Default Diets

Insight

Gen Z consumers are much more likely to have dietary restrictions or to follow specific diets than the total population: 66% of Gen Z consumers follow a specific eating pattern or diet, vs 63% of millennials, 50% of Gen X and 41% of Boomers, and 10% of students on meal plans having food allergies vs 6% of the adult population. These consumers grew up with food technology addressing these needs (e.g. plant-based meat) and they’re increasingly expecting options that allow them to follow their diets without sacrificing quality.

Provocation

As dietary needs and restrictions become more and more common among Gen Z (Gluten free, plant based, allergens) there is an opportunity to delight consumers with higher quality options meeting these needs. Brands that have been able to address these needs are thriving (e.g. Siete, Made Good, Nature’s Bakery). How can companies deliver dietary needs without sacrifice in retail?

On Campus Examples

Craving Customization

Craving Customization

Insight

Gen-Z has a desire for unique custom offers. Whether driven by dietary restrictions, a desire for greater variety, or a focus on individuality, consumers want and expect their food to be customized to their personal taste.

Provocation

Customization is becoming the norm – brands offering personalized products (Prose, Function of Beauty, Gainful Protein, etc.) are disrupting their respective categories. Where else can this be applied?

On Campus Examples

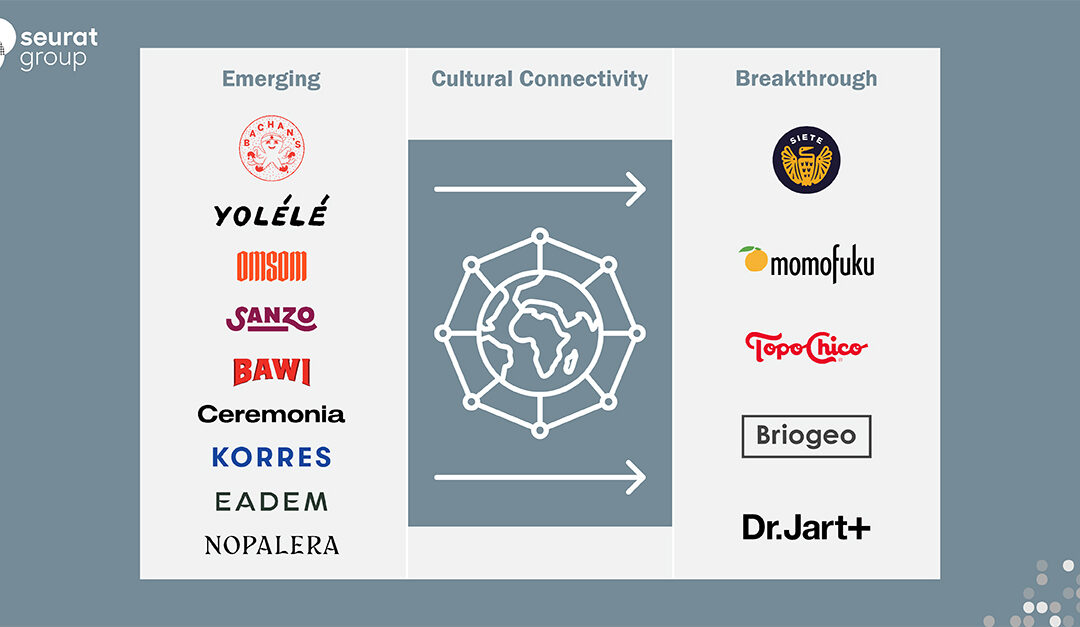

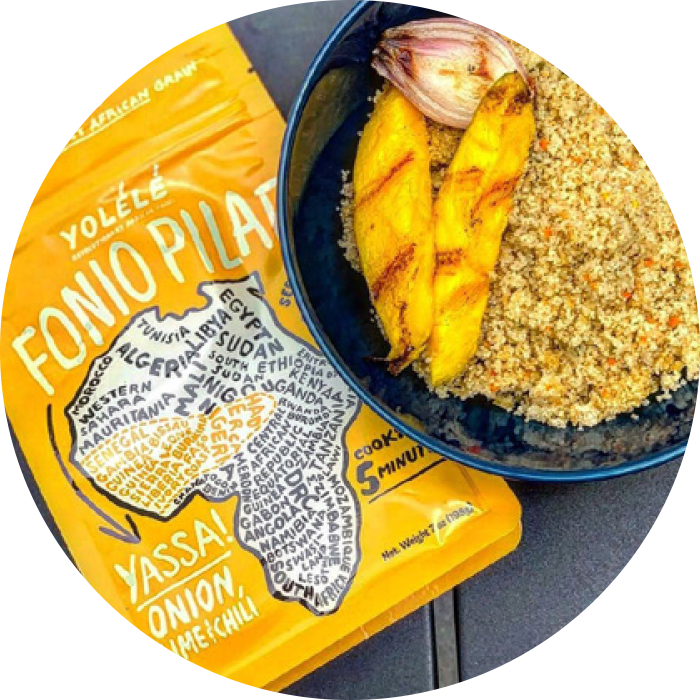

Global Grub

Global Grub

Insight

As the US becomes increasingly multicultural, Gen-Z is increasingly eager for ethnic flavors and cuisines. Multicultural students expect offerings that represent their cultures, and most students expect offerings that expand their palates.

Provocation

Authentically delivering flavors and products from other cultures is a massive opportunity, especially for cultures that are less well represented today. How can we bring international cuisine beyond the basics of Chinese, Indian and Mexican to life at retail?

On Campus Examples

Creating Community

Creating Community

Insight

In the post-covid world, students see food as a key element of building community. This is true both with their immediate on-campus community (they spend long hours socializing in dining halls), and with the broader local community (they prioritize eating at local restaurants).

Provocation

Gen Z consumers look to food to help them connect both with their social circles as well as with their local communities. How can companies better deliver a sense of community in retail through messaging or targeted innovation?

On Campus Examples

Socially Savvy

Socially Savvy

Insight

Gen Z are digital natives who have grown up with unrestricted access to social media and rely on technology heavily in food. Influencers and celebrities have a big impact on their eating behavior, to the point where Gen Z often learns to cook through social media, and regularly try viral recipes.

Provocation

Social media and food are intertwined for Gen Z at an unprecedented level. Leveraging virality of recipes to resonate with Gen Z through LTOs and comms, and partnering with key influencers for product innovation are key opportunities, but how else might companies leverage the role of social media in Gen Z’s culinary development?

On Campus Examples

In summary, Gen Z college students want diverse multicultural and local foods to build community, both customized to their needs and available any time. Companies that can deliver on these needs in retail will be set up for success as this generation moves into the workforce and becomes a significant driving force in the economy.

As always, we want to hear from you! If you want any more information on any of our white papers, or have questions on how your brand can better address these needs, please reach out at info@seuratgroup.com.