What’s the Why?

What’s the Why?

Today, brands have more data at their fingertips than ever

before. The challenge? Many become overwhelmed or follow it blindly, missing the all-important whys needed to shape smart strategies. Consider these examples:

- A pet food brand invested in performance marketing but struggled to articulate underlying attitudes and unifying motivations of its target cohorts, severely limiting the effectiveness and efficiency of its marketing investment.

- A confectionary brand invested in keyword tracking of a given category with three key retailer partners to support collaborative innovation. They were able to identify key claims and tag lines that performed well in the past 52 weeks but could not isolate brand vs. retailer choice factors.

- A produce brand built a custom dashboard to integrate three different data sources and found they had a clear view to what happened in the past, but no understanding of how to influence consumers looking forward.

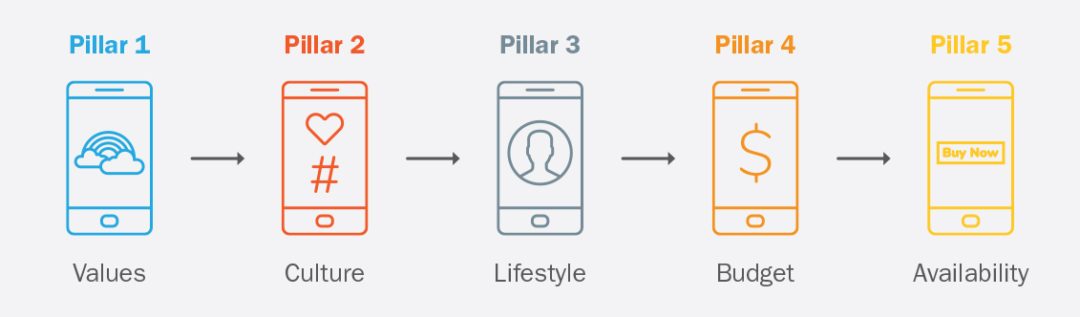

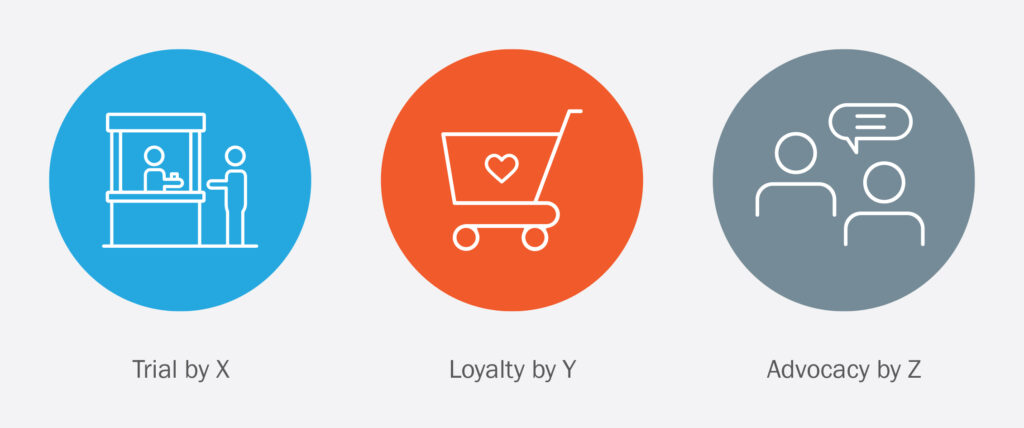

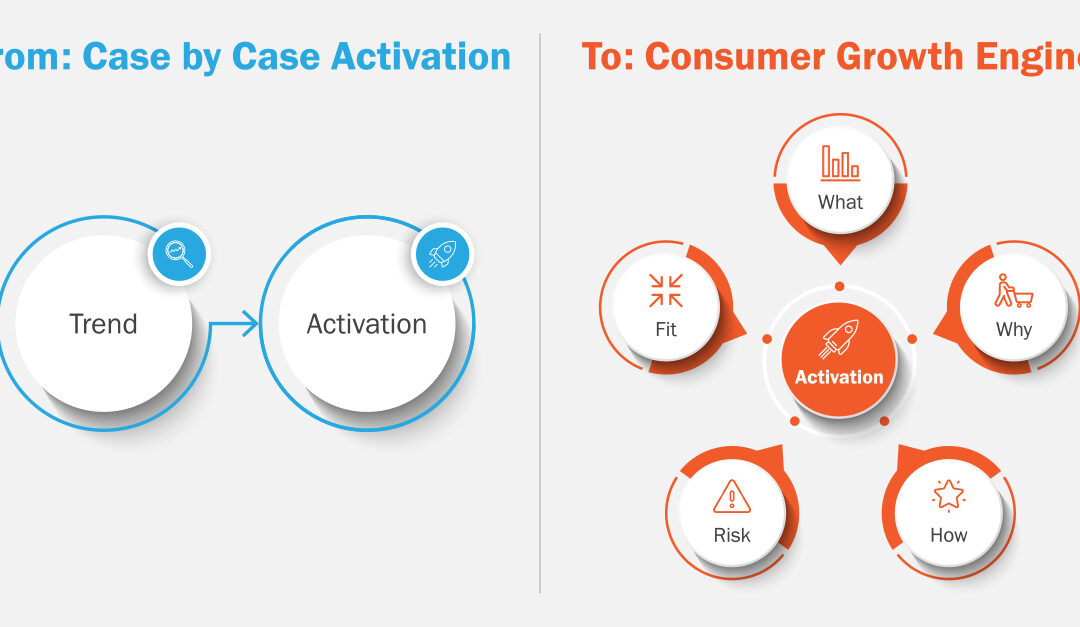

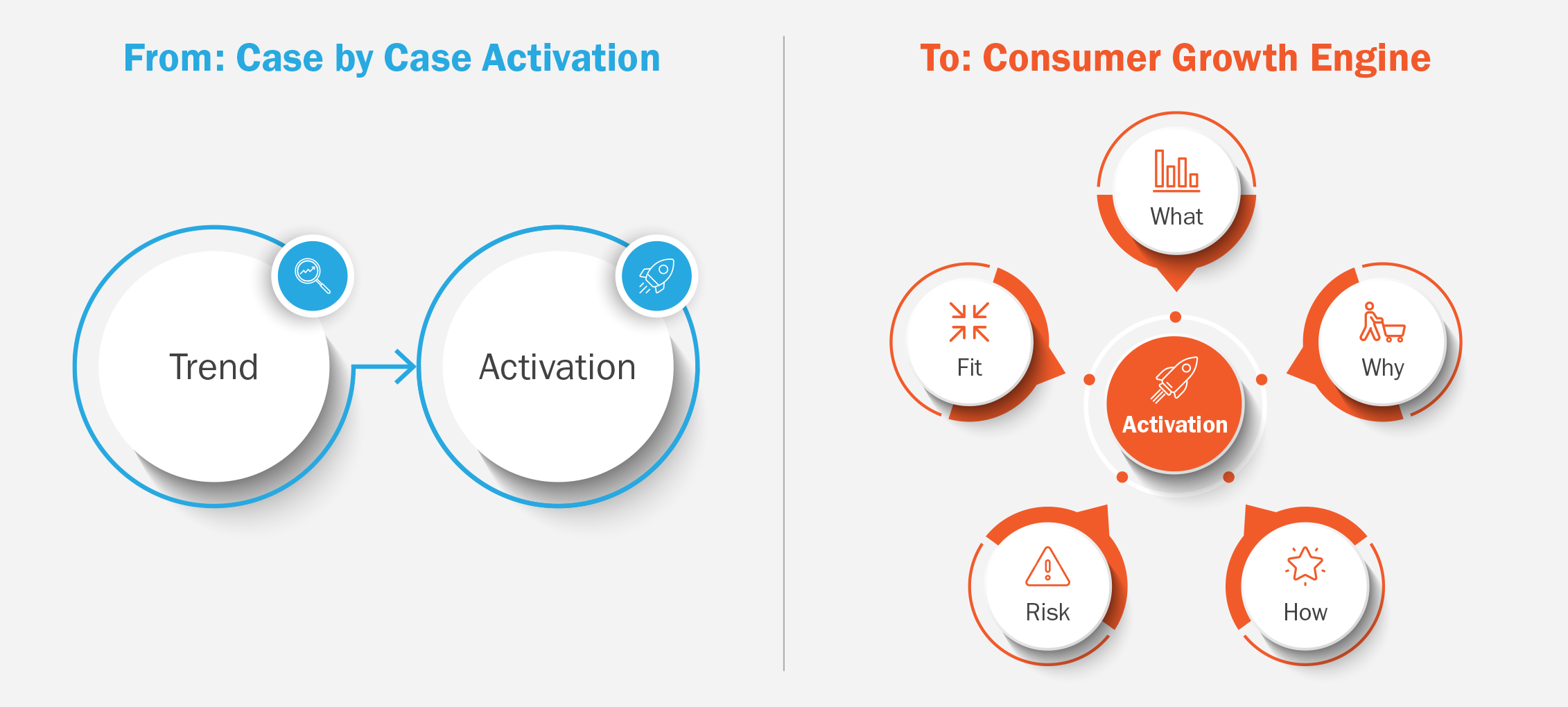

Scenarios like these are becoming all too common as marketers are overwhelmed with data sources and the opportunity to test/learn, drive performance marketing, and optimize brand strategy. As Advanced Analytics and Insight teams build capability with data analytics, it is important to understand this is only one part of a more comprehensive consumer growth engine. It is the ‘What,’ as in ‘What is the data telling us?’ Sustainable growth comes from utilizing all five pillars of the Consumer Growth Engine.

- What: What is the data telling us?

- Why: Why is this happening? Where is the consumer headed? (core insight)

- How: How does insight come to life as activation?

- Risk/Opportunity: What does this mean for competition? R&D? Retail relationships?

- Fit: Can this brand do this meaningfully? Is there mission fit? Consumer permission?

Growth Strategy across the demand plan is limited without factoring in all five pillars. A key first step is moving beyond the what and asking, What’s the Why? That will drive greater human understanding and engagement.

A leading dairy brand provides an example of how the

Consumer Growth Engine creates opportunity.

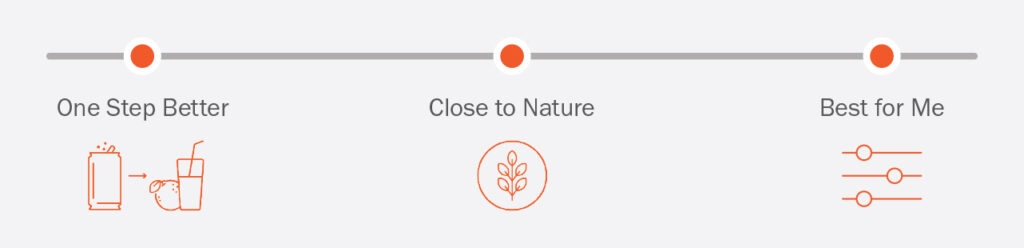

A leading premium dairy brand plays in the family-size and pint-size ice cream space. Trends indicate that plant-based ice cream is where the growth resides. Brands are diving into plant-based expansion, and consumers appear passionate about it, driving an 11% CAGR for plant-based ice cream. Had the brand relied solely on data, it would have jumped headlong into plant-based ice cream. Instead, the team dug deeper into the whys, recognizing that in ice cream, plant-based ingredients matter far less than winning on taste and indulgence. The result? While competitors jumped on the plant-based bandwagon, the brand launched a rich, ultra-creamy custard innovation that outperformed the plant-based segment.

- What: Ultra-creamy, rich, high-end French (egg-based) custard ice cream.

- Why: Consumers turn to ice cream for indulgence and ‘worth it’ taste, not a watered down, better-for-you version.

- How: Build on the legacy of the brand and provide premium pints of consumer faves

- Risk: As other brands pursue one-off innovation with each new trend, this premium dairy brand doubled down on core equities, facing fewer competitors by providing decadence and finest quality.

- Fit: Plant-based could not fit with the brand and legacy. Activating on an insight that fits with the core promise of the brand led to rapid success.

Big data has the potential to help brands in numerous ways. Consequently, the global data market is worth an estimated $70BB in 2022, driven by messaging that growth will come with more data or faster analysis. The hurdle is that relying on big data alone gives brands ammunition to analyze only the “What.” Big data can over-shadow other parts of the consumer growth engine which are needed to create and capture consumer value. There are plenty of companies offering more data and platforms to churn through that data at an increasing rate. However, sustainable growth requires insights to blend with analysis and ultimately understand the “why.”

How to get started

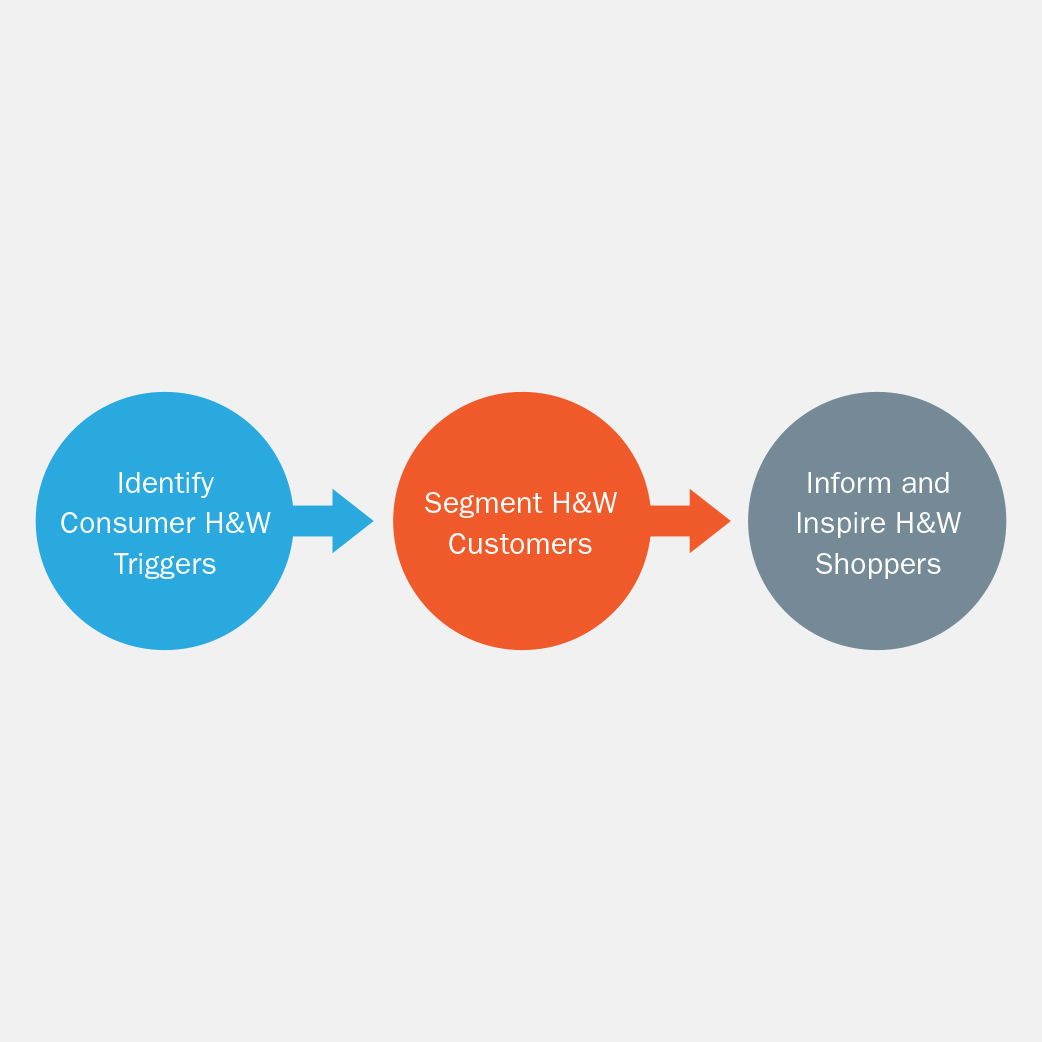

To establish and action the Consumer Growth Engine leaders must ask, ‘What’s the Why?”, and brands must:

- Build forward-looking data sources and analytics

- Create cross-functional Consumer Growth Engine teams

- Collect and connect consumer “why” insights and combine with “what” data

- Wire a process to action Consumer Growth Engine insights

Are you ready to unlock the “why” of your brand to drive future innovation and growth? We welcome conversation at info@seuratgroup.com.