Predicting The Future In CPG

Predicting The Future In CPG

“An organization that doesn’t leverage its data in [a predictive] way is like a person with a photographic memory who never bothers to think.” – Eric Siegel, Predictive Analytics: The Power to Predict Who Will Click, Buy, Lie, or Die

“An organization that doesn’t leverage its data in [a predictive] way is like a person with a photographic memory who never bothers to think.” – Eric Siegel, Predictive Analytics: The Power to Predict Who Will Click, Buy, Lie, or Die

The Power of Predictive

Predictive analytics is as close as an organization can get to peering into a crystal ball. It is the answer to the billion dollar question: “what is going to happen?”

From projecting the effectiveness of door-to-door campaigning during the 2012 presidential election to forecasting the number of high-risk patients for healthcare providers in the US, predictive analytics provides a distinct competitive advantage to those willing to invest. The problem is that few in CPG have realized this potential.

Definition:

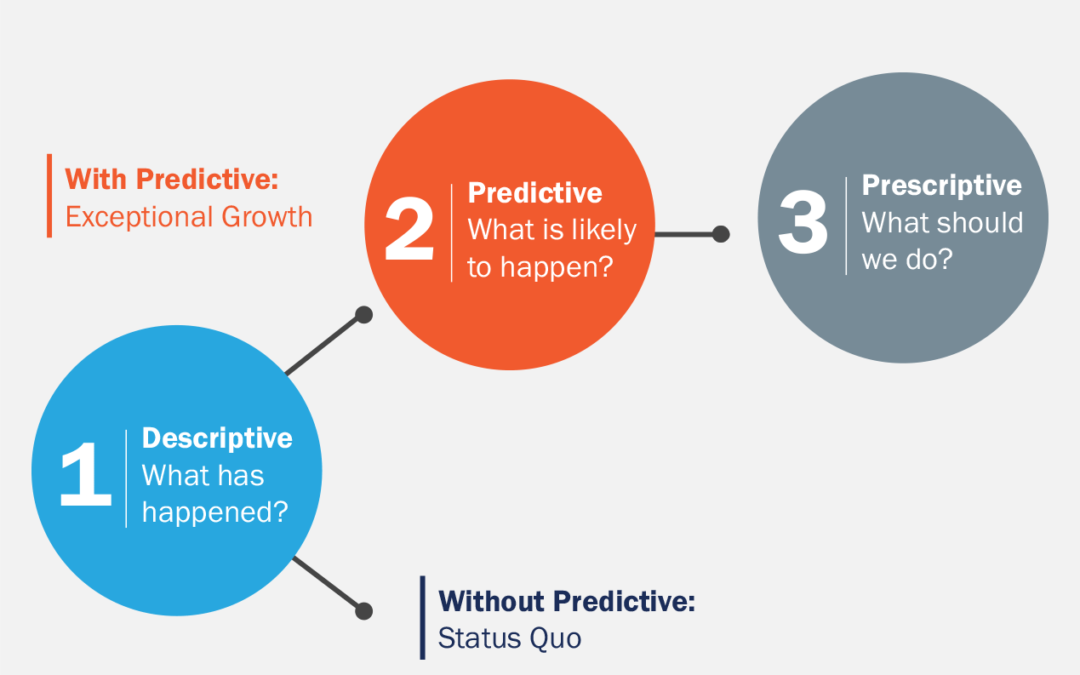

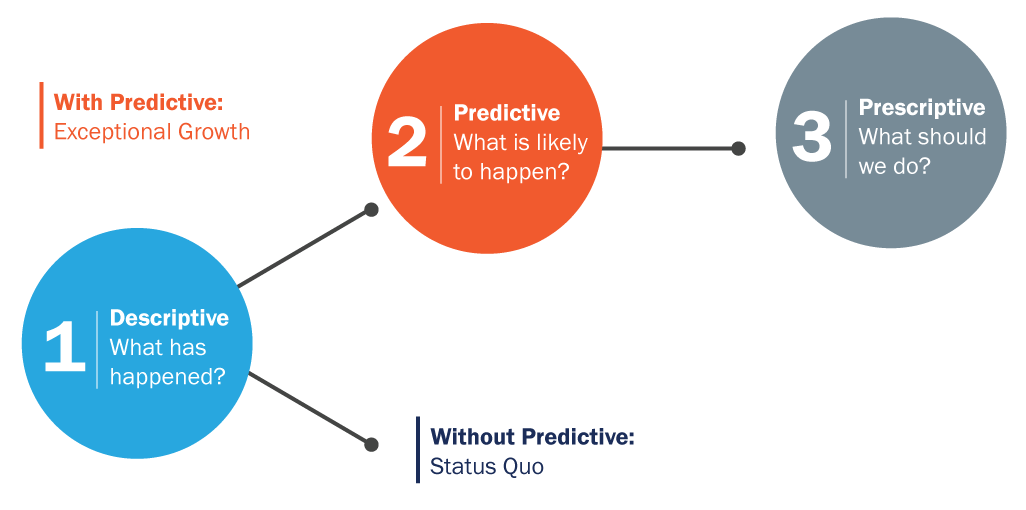

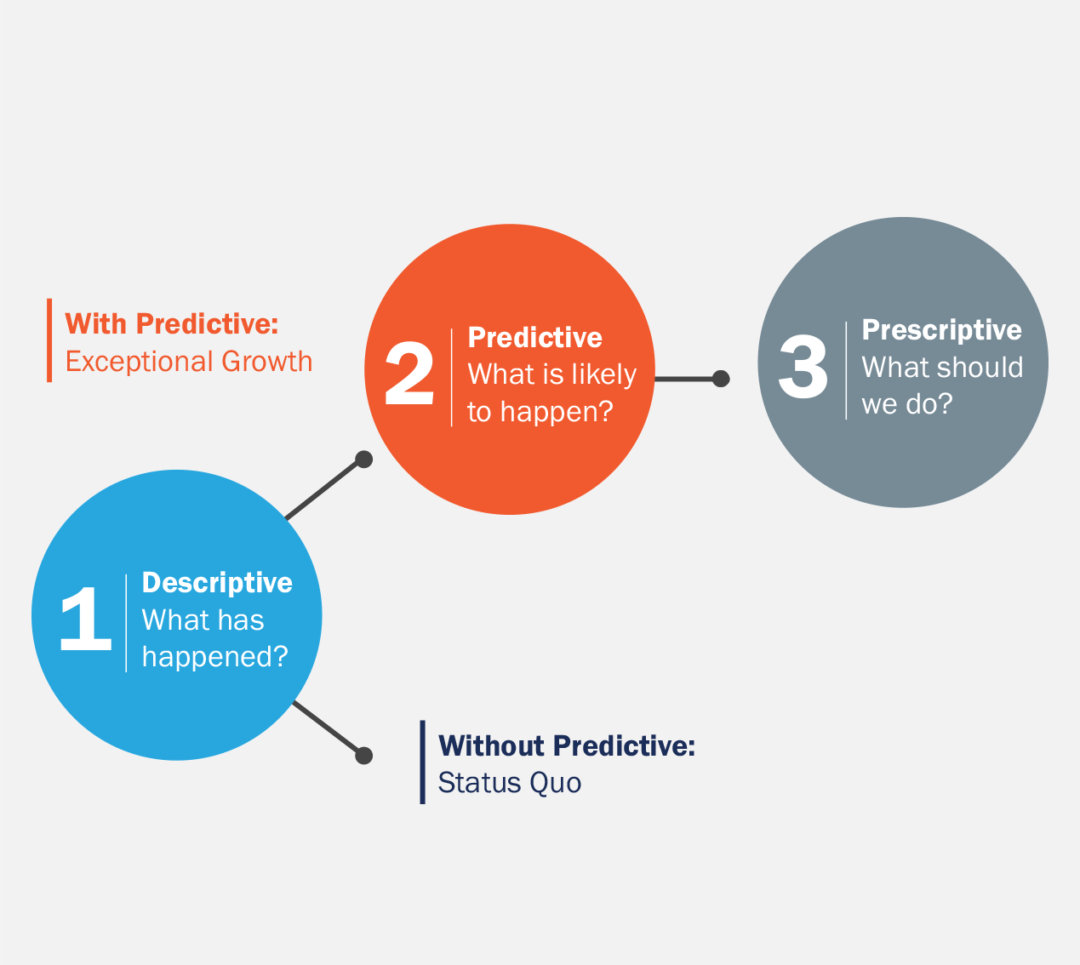

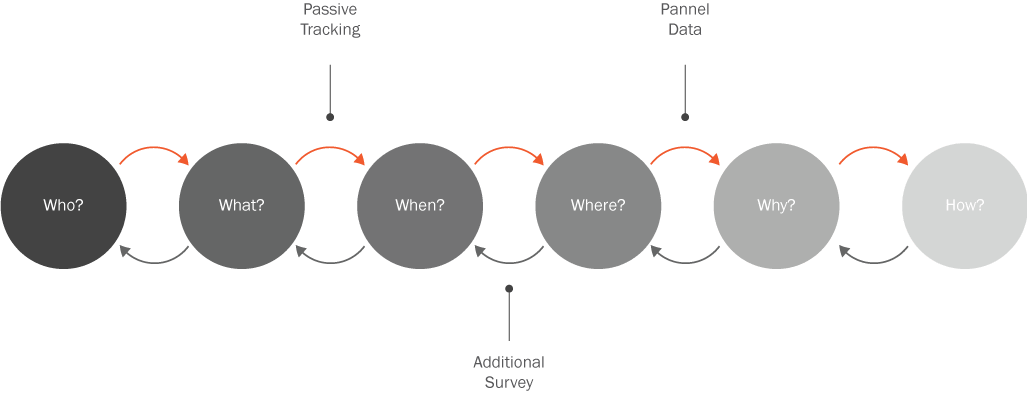

Predictive Analytics: The logical answer to the “what is likely to happen?” question. It is the practice of analyzing current and historical data to logically forecast future outcomes, trends, and behavior patterns.

Application:

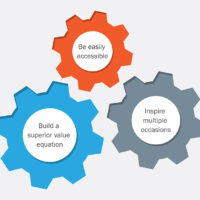

Predictive analytics enables companies to transform from reactive followers to proactive leaders.

Realizing the Predictive Potential

CPG retailers and manufacturers have mastered the art of descriptive historical analysis, which is valuable in its own right – for maximizing performance, reducing inefficiencies, and understanding how to better deliver against consumer and shopper needs.

Delivering against yesterday’s needs, however, fails to help these companies win in an ever-changing “world of tomorrow.” It skips the most important step in a powerful three-pronged approach1 to data analysis: prediction.

Predictive analytics has exploded across industries this decade. In fact, the use of predictive analytics more than tripled during the five years following the end of the recession, becoming a key strategy for unlocking growth.

Amazon is one company famous for its investment in predictive analytics, most notably to power its recommendation engine. Amazon’s predictive model is so effective that sales from recommendations account for more than 1/3 of total revenues.

The company is now turning its attention to a new predictive application: an anticipatory shipping model that cuts delivery times by shipping products to consumers, or in their direction, before they order them – all based on purchase predictions.

Spice manufacturer McCormick has also reaped the benefits of predictive analytics through its personalized recipe recommendation engine, FlavorPrint.

FlavorPrint initially gauges consumer taste preferences using a 20-question online quiz, and continually refines profiles by analyzing rated recipes and variables like weekday versus weekend patterns. It predicts which recipe recommendations consumers are likely to choose and when they are likely to choose them.

Thanks to predictive analytics, McCormick has captured a valuable competitive advantage in the digital engagement space. The company boasts 6 times more pages per visit to its website and an average website stay of 7 minutes5 – a number unheard of for most manufacturer websites.

It is programs like this that have made McCormick a proactive leader in CPG, contributing to the company nearly doubling its stock price over the past 5 years.6 There is a clear opportunity for other manufacturers to follow suit and invest in predictive analytics so that they too can transform from reactive followers to proactive leaders.

Applying Predictive Analytics in CPG

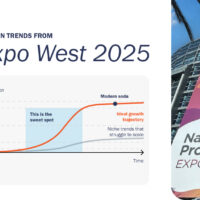

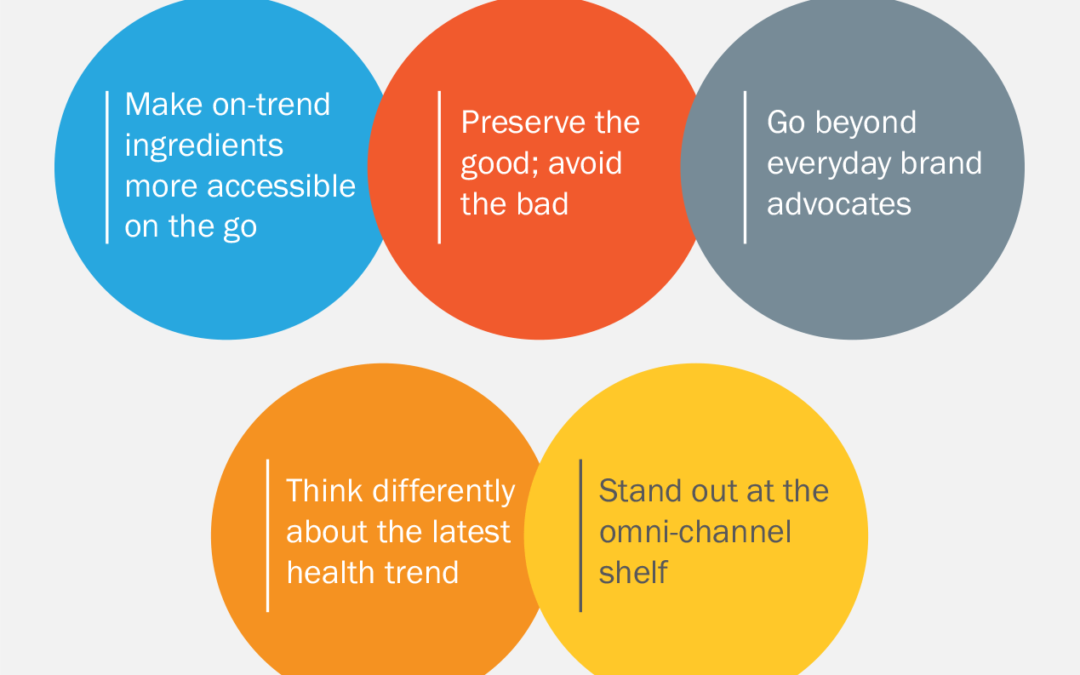

It’s clear that predictive analytics is a burgeoning game changer in CPG – the cornerstone capability for unlocking future growth.

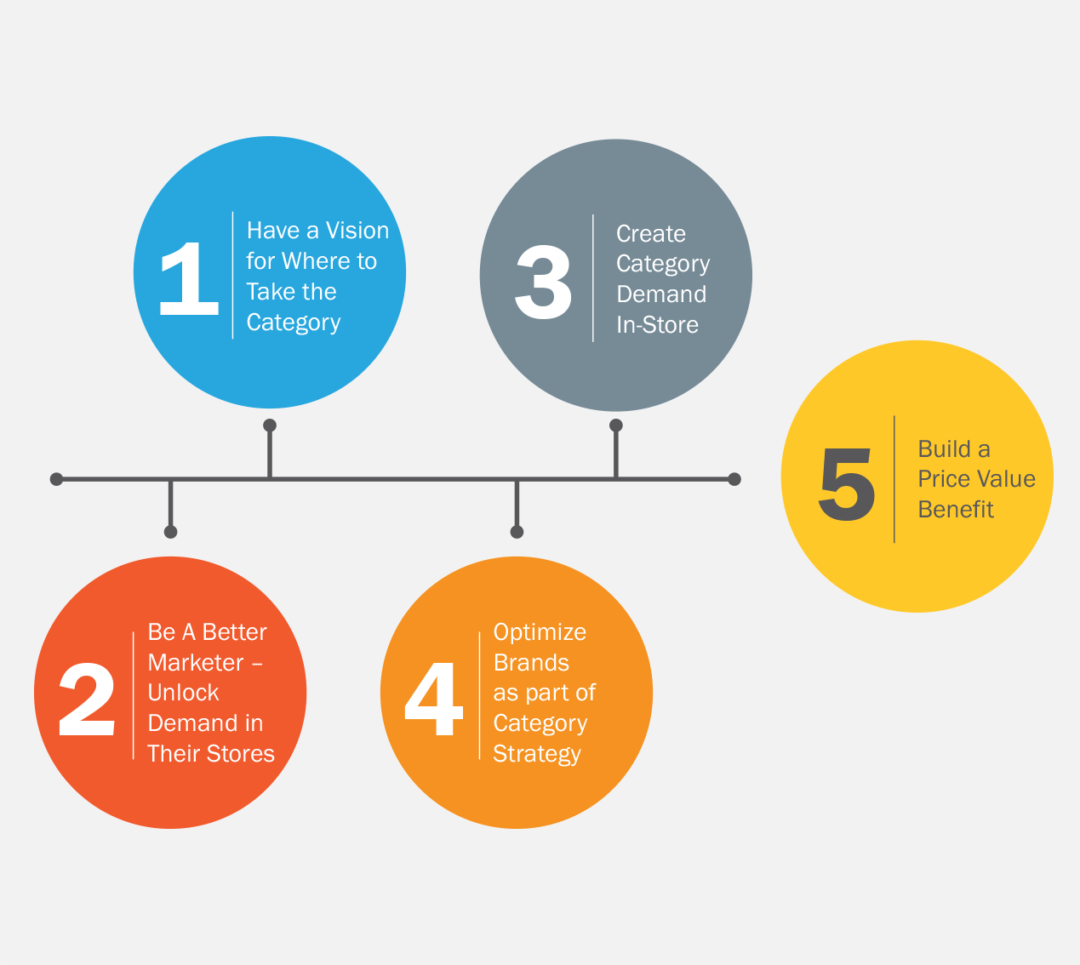

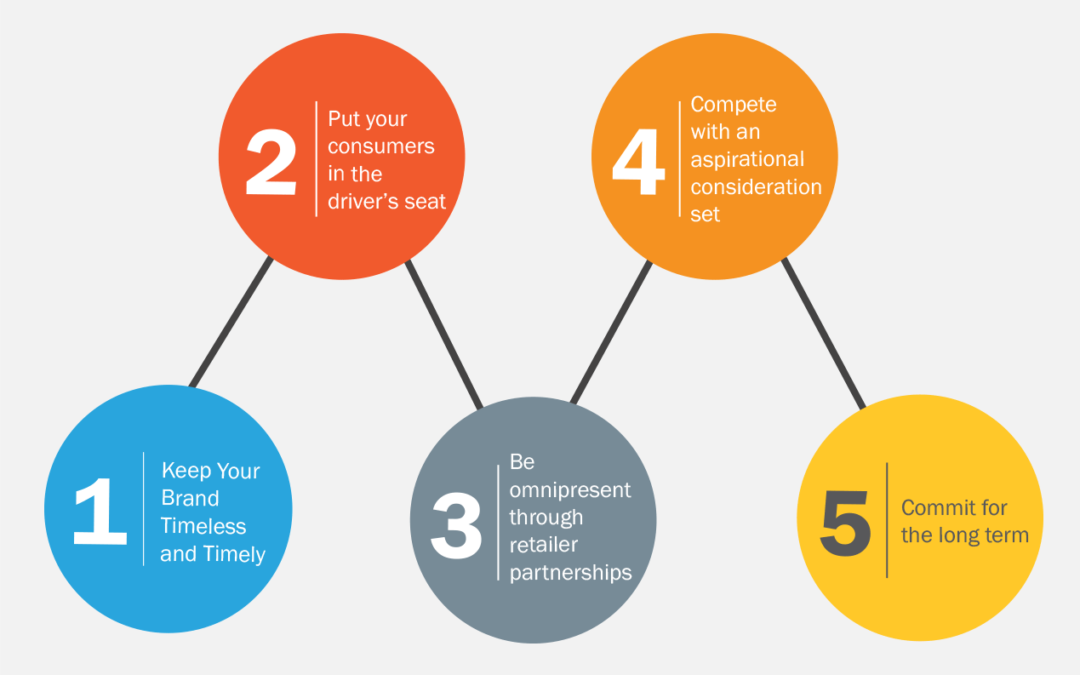

Through years of helping clients leverage predictive analytics, we have identified 4 valuable applications across the industry:

By leveraging predictive analytics to identify future consumer trends, a leading regional grocer optimized its portfolio of 20+ private brands down to 6 platforms well-aligned to current and future shopper need states.

End result: a strategic portfolio of brands that played well across all shopper segments.

The Clorox Company introduced a cold & flu Twitter conversation tracker that predicts flu incidence throughout the year based on volume of social engagement.

With this capability, Clorox can pinpoint peak flu season more effectively, and thus market cleaning products when and where consumers need them most.

A mid-sized manufacturer used predictive trigger analysis to identify factors that lead to the highest category spending.

This future-looking insight provided a more robust fact base beyond the usual category management metrics, and ultimately helped the company persuade retail partners to adopt its proposed guidelines – gaining share of shelf that exceeded share of sales.

A leading produce manufacturer built its long-term strategy based on forecasted purchase behavior. Using predictive analytics, it developed a future-looking decision hierarchy (PDH) that helped orient the business around a category-view of the behaviors predicted to unlock the greatest volume.

Conclusion

Tomorrow’s leaders will adopt predictive analytics as part of their foundational insight capabilities. It will take patience, careful planning, and a comprehensive strategic plan.

Despite these extra efforts, retailers and manufacturers that take strides to master the power of prediction will no longer act as passive followers, but rather proactive leaders capable of dictating the future. Companies that invest in predictive analytics will stay ahead of trends and drive growth, entering category whitespace before competitors get the chance to identify the same opportunities. They will be tomorrow’s leaders.

For more information on how predictive analytics can impact your business, contact the Seurat Group (info@seuratgroup.com).

Whole Foods:

Whole Foods: Meijer :

Meijer : Kroger:

Kroger: Walmart:

Walmart:

“When we look at growth strategy, it comes down to finding the best way to inspire, educate and engage people who see clean nutrition as a support for healthy living.” – Cristina Pagnucco, Social Media and Online PR, Vega6

“When we look at growth strategy, it comes down to finding the best way to inspire, educate and engage people who see clean nutrition as a support for healthy living.” – Cristina Pagnucco, Social Media and Online PR, Vega6

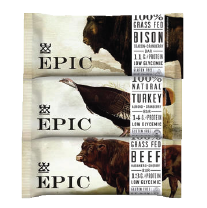

“Protein is hot, hot, hot. Brands like Builders (from CLIF), Pure Protein, and ProMax were killing it for a while, but their growth has slowed as consumers are looking for cleaner protein sources.” – Industry Expert

“Protein is hot, hot, hot. Brands like Builders (from CLIF), Pure Protein, and ProMax were killing it for a while, but their growth has slowed as consumers are looking for cleaner protein sources.” – Industry Expert